Walmart Media Group; Marketplaces; ’21 Amazon Forecasts

By Cleveland Admin

Our research suggests Walmart is expanding its advertising inventory meaningfully and asking vendors to significantly increase their investments with Walmart Media Group (WMG). With Walmart’s new integrated merchandising structure, WMG team members are beginning to join more meetings between the buyer and vendor and the pressure to invest greater funds is increasing for many manufacturers. Our research points to WMG presenting different tiers of spend to vendors, with the top tier including joint business planning and greater access to data.

Many brands are responding with increased investments, with some noting they plan to double their WMG investments in 2021 relative to 2020. Our eCommerce Summit Live Polling in October also showed paid search will be brands’ top priority for the Walmart.com business in 2021. However, brands tend to be increasing spend more so to improve standing and partnership with Walmart due to the overall size and importance of the Walmart account, and less so because of a strong ROI. Brands continue to feel Walmart has a ways to go in terms of capabilities and demonstrating a strong ROI. Compared to its peers, reporting appears to be more delayed and less robust and actionable, and its targeting capabilities are limited by poorer customer data, likely due to the lack of a loyalty card or program. In addition, some brands lack digital advertising expertise on their Walmart teams, making it difficult to understand and leverage the opportunity. Our research suggests a few capability improvements are on the horizon for WMG, including the ability to leverage brands’ customer databases for more powerful targeting and the ability to run in-store activations in conjunction with digital campaigns.

Source: Walmart Corporate

Kroger promotes its general merchandise offering through marketplace capabilities:

Kroger announced the launch of its marketplace in August through its partnership with Mirakl, a software platform enabling B2C and B2B digital marketplaces. Since the launch, management hasn’t provided much detail on performance, but we’re seeing the company drive consumer awareness of it and promote its expanded selection of housewares, toys, and more through the holiday shopping period. Marketplaces continue to grow in prevalence across the retail landscape, with retailers like Kroger using it to expand beyond its traditional selection, and mass retailers like Amazon relying on marketplaces to offload long tail and lower-margin SKUs from their own 1P retail models. As an example, our latest research suggests Walmart may begin cutting long tail and lower-volume SKUs from direct distribution and pushing these items toward its marketplace.

While marketplaces can create additional challenges for brands, they also offer benefits and opportunities such as go-to-market flexibility, price control, and more direct access to customers. According to our recent Amazon Teams Benchmark, 35% of brands are exploring these marketplace benefits today by operating under the hybrid model on Amazon, in which they are set up as both a 1P vendor and a 3P marketplace seller.

Source: Mirakl

Manufacturers raise ’21 Amazon forecasts by 10 points:

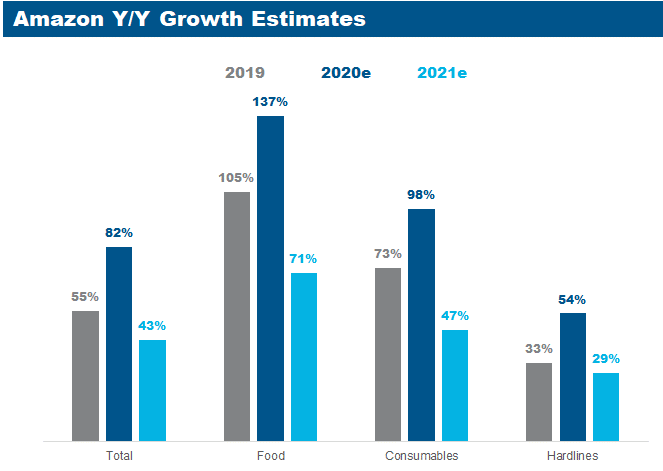

Compared to our benchmark study in July, manufacturers, on average, have increased their outlook on Amazon by 10 points, with growth expectations now at 43% Y/Y for 2021, compared to the estimated 82% Y/Y that is expected in 2020. The projections for ’21 imply a rate of growth below the pre-COVID-19 growth rate (+43% Y/Y in ’21 vs. +55% in ’19). This outlook seems reasonable, as we project the overall digital market to grow in 2021, but at a slower-than-pre-pandemic trend given the challenge of comping the high rate of growth that aligned with the start of the pandemic in 2Q. In our research, most brands think 1Q20 will look similar to 4Q20 in terms of the magnitude of sales coming from online, and then expect a more material Y/Y slowdown as they start to comp the pandemic. In addition, positive news on the vaccine front will also likely result in greater in-store shopping, although our research in both grocery and general merchandise categories suggests a high degree of online retention is likely post-pandemic.

Source: CRC COVID-19 Benchmark, December 7, 2020, n=55