Walmart Connect Update, 2Q22 eCom Recap, Amazon Seller ‘Packable’ Ceasing Operations

By Cleveland AdminWalmart Connect Update – positive feedback in light of cost pressures brands are facing:

In our latest Walmart Connect Update, we take a look at how brands are investing into the platform given macroeconomic pressures. Overall we’ve seen that brands are still investing on budget given the high conversion rate of retail media investments and an overall allocation to lower-funnel ads during this time. By comparison, we have seen vendors pull back from upper-funnel investment like off-site search (Google) and social (Facebook, Instagram, Snapchat, etc.).

Other key takeaways:

- Some incremental spend has been put on hold to 2023 which has resulted in fewer tests around live streams, Trade Desk, and fewer holiday-oriented partnerships. Spend that has already been locked in through JBPs is generally going towards search rather than display.

- Walmart’s partnership with the Trade Deck DSP appears to have made interaction with the WMC platform easier. For example, advertisers are now seeing more success creating audiences, effectively retargeting, and receiving more closed-loop reporting. Initial brands to try out the DSP were large CPG brands. Since then, broader adoption to products in all categories has evolved (tech, home goods, other non-food categories). At present, brands appear to be spending around 10-15% of their total Walmart Connect budgets on the Trade Desk DSP.

- Walmart launched their second-price auction which appears to be helping to lower CPCs and reduce waste of daily budgets. Average CPCs look to be as much as 20% lower depending on category which allows budgets to last longer throughout the day.

- Feedback on Walmart’s Luminate is still mixed as vendors find it expensive and a bigger resource-drain than previously anticipated. Walmart appears to be charging around 0.3-0.5% of POS for access to Luminate, a pricey fee given budget constraints. Additionally, agencies are not able to access Luminate so internal brand teams are forced to do their own analysis.

2Q22 eCom Recap – Retailer Results:

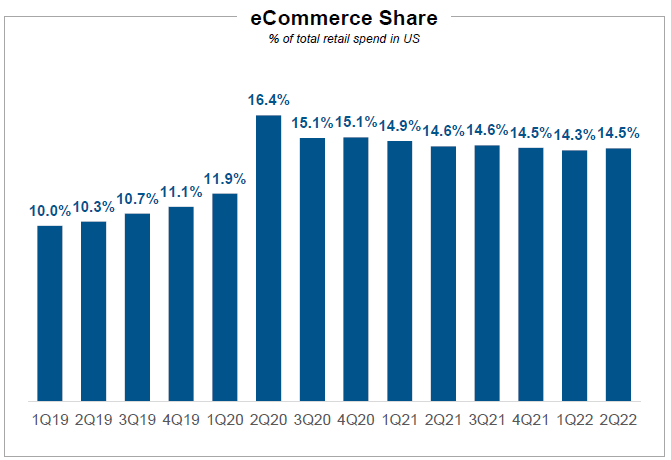

Yesterday we released our 2Q22 eCommerce earnings recap for a variety of retail accounts. The biggest overarching theme of these results has been one in the making since the start of 2022 which is that eCommerce penetration is really remaining stagnant, very much in-line with pre-COVID trends. This suggests that we are at a level that may have been achieved whether or not the pandemic happened. Despite the steady state of shopper behavior, the pandemic did truly accelerate retailers to now have a comprehensive digital offering and an opportunity to get strategic in 2023.

Top takeaways this quarter by retailer:

- Home Depot / Lowe’s – Home Depot reported 2Q22 ecommerce sales growth of +12% Y-Y vs. Lowe’s at +7% Y-Y. Both homecenters continue to fulfill more than half of online orders through their stores and focus on being omnichannel retailers. Home Depot’s management team noted that they are still on track to reach their ‘One Supply Chain’ strategy goals (which includes more flatbed distribution centers), and Lowe’s management team mentioned how they are leaning into a new Pro fulfillment center in Charlotte, NC and a gig network to offer same-day delivery.

- Amazon – This quarter Amazon saw 2Q22 net sales growth of +7% Y-Y which was in-line with 1Q22 and +91% on a two-year basis. Despite strong growth, management did note that they plan to reduce their pace of capacity expansion to reduce costs. Amazon’s Advertising revenue grew +18% Y-Y, showing the insulated resilience of retail media from macro headwinds. On the earnings call, management noted that 57% of units sold in the quarter were from 3P sellers (a new record) and that they don’t really have a preference between 1P vs. 3P so long as people are using Amazon for it’s core principals of value, convenience, and efficiency.

- Walmart / Target – Walmart reported 2Q22 ecommerce sales growth of +12% Y-Y vs. Target at +9% Y-Y. This quarter Walmart’s 3P marketplace grew substantially Y-Y (+60%), and Walmart saw success in its global ad business growing nearly +30%. Still leaning into omnichannel and fulfillment efficiencies, Walmart saw the volume of its online sales delivered from stores grow +40% Y-Y, and management noted they expect GoLocal to have 5k pickup locations by end of year. On the Target side, management is focused on growing same-day/rapid-delivery services and drive up. Target plans to rollout 200 full remodels to current stores this year to increase upstream capacity. Additionally, Target plans to add 5 more sortation centers in early 2023 (currently 6) to help expand Shipt’s delivery capabilities from being a store-to-home model to being a store- or warehouse-to-home model.

Amazon 3P seller ‘Packable’ is ceasing operations:

With the announcement of Packable (one of Amazon’s largest sellers) liquidating and going out of business, we continue to see negative inflections within the aggregator space. In May we highlighted the consolidation, layoffs, and leadership changes taking place within the space due to a number of industry factors including 1) rising costs, 2) elevated CACs, 3) debt covenants, 4) tougher fundraising environment, and 5) more modest sales.

Feedback continues to suggest there is likely more shake out to take place in this space as headwinds persist. We believe it is worth revisiting and updating the headwinds we discussed in May which outline the challenges facing these operators.

- Rising Costs: Aggregators (like all organizations) are being faced with rising costs across their supply chains. This includes FBA fees which have steadily risen over the last few years. Challenging the economics for aggregators is the lack of scale benefits gained from using FBA. Specifically, as aggregators grow in size, they do not receive reduced FBA rates (as they might with other distributors / logistics companies) as Amazon does not have a vested interest in reducing shipping and warehousing fees since no single seller is big enough to impact their business.

- Modest Sales: Following the pandemic-fueled wave of online sales, digital sales have slowed with eCommerce penetration moving backwards in some categories as consumers naturally return to brick & mortar channels. While eCommerce penetration will grow long-term, online sales will likely reflect this more modest trajectory over the near-term as brands / companies lap 2-years of strong growth.

- Elevated CACs: In addition to rising shipping and product costs, CPCs and advertising costs have remained elevated adding to the bottom-line pressures.

- Debt Covenants: Much of the money raised by aggregators over the last few years was debt financed and included covenants (protective measures for lenders). So, as EBITDA / profits tighten, many of these businesses may not have the margin flexibility or ability to invest in the business as they previously had.

- Public & Private Fundraising: On the equity side, raising capital in both public and private markets is more challenging today (compared to ~12-24 months ago) forcing companies to tighten belts and make cash reserves last longer.