Virtual bundling on Amazon, 2022 POS expectations, Macro Supply-Demand Balance

By Cleveland AdminIncreased vendor interest in virtual bundling on Amazon:

A common theme in our research recently has been increased interest to test and learn with virtual bundling on Amazon. Given the push from Amazon for vendors to broaden their assortment and to prioritize lower priced ASINs, brands are getting creative with virtual bundling. Some tips as for brands looking into bundling are 1) to look at what is cross-selling naturally, 2) variate the bundle against an ASIN that already has a good organic ranking, and 3) leverage your SAS to help set up the bundle. We’ve heard challenges with A+ content on the PDP not working properly. Additional watch outs include virtual bundles being excluded from Subscribe & Save, and that the two (or more) products within a single bundle must contain different variations of the product (i.e. two different flavors, not two of the same).

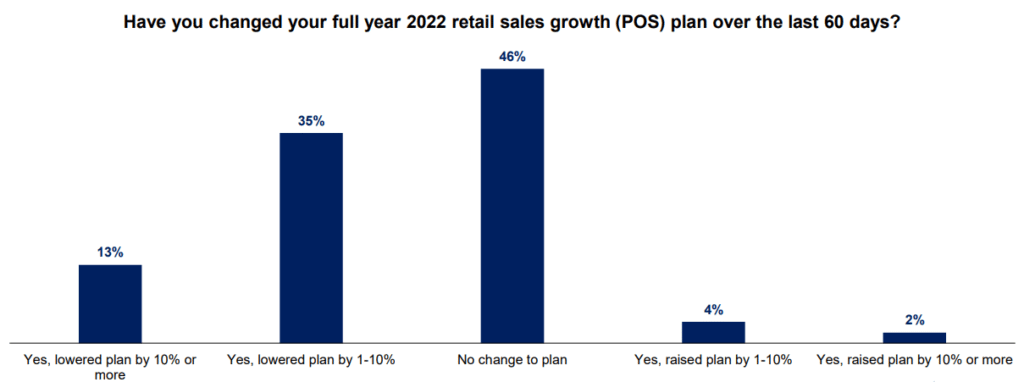

Net 42% of brands reduced full year 2022 retail forecasts:

Based on our Traditional Retail Council’s benchmark, a combination of softer-than-expected demand and elevated inventory are leading to a reduction in full-year sales outlook for 48% of brands (with 46% maintaining original plans). Over the past month, mass retailers like Target and Walmart have expressed that they are going to increase promotions to off-load excess inventory, a trend that we called out in our supply chain update in May. We expect incremental margin pressure for suppliers based on order reductions, incremental margin requests from retailers, and liquidating inventory. The early-read on 4Q/Holiday also sounds cautious with suppliers/retailers reducing plans and expecting further inventory forward order reductions.

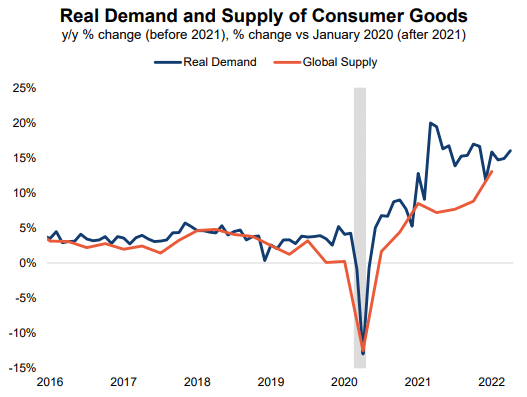

Supply-demand gap continues to persist, potential recession would likely bring closer to equilibrium:

The surge in foreign goods imports and the return of domestic supply are still not enough to meet the strong consumer demand, leading to the continued gap between consumer goods’ demand and supply. The gap surged to an unprecedented level of 12.2% in 2Q21 and has slowly normalized to 2.8% in 1Q22. As of 1Q22, we are experiencing the longest gap period in history (1.75 years) amid both robust demand and supply chain disruptions.

The gap is likely to widen in 2Q22 as real demand remained strong while supply has been impacted by the shutdowns in China and disruptions from Russia/Ukraine. Moving forward, if a mild recession were to dampen demand, we may see the gap close by the end of 2023.

Source: FRED, Cleveland Research Company

Subscribe to 3 Things Weekly email

*all fields required