Top 5 account priority; Brands forecasting strong growth; B&M store expansion

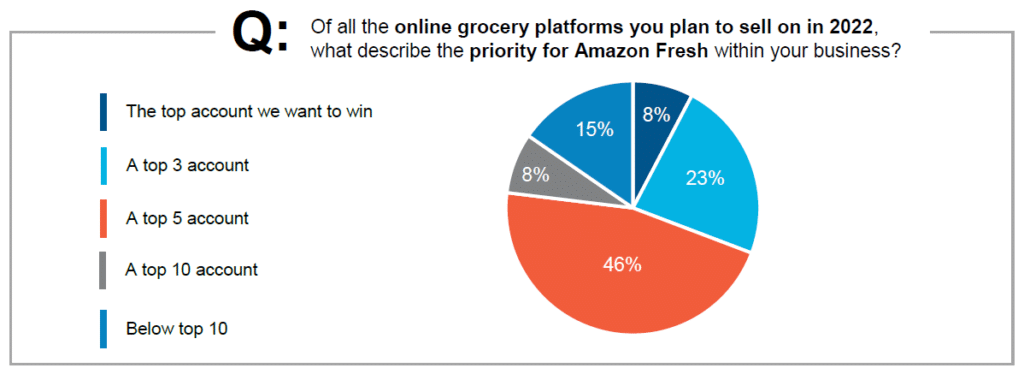

By Cleveland AdminAmazon Fresh is a top 5 account for 77% of brands:

In our latest Amazon Fresh update we found that despite supply chain challenges, the majority of brands are prioritizing Fresh in 2022. Brands are continuing to experience growth on the platform and hope that some of the common executional issues (like lack of communication between internal Amazon teams, low data visibility, OOS issues) are solved in 2022. In our research we’ve found that the account most competing for space in brands’ priorities for the year is Instacart. Although Instacart comes with its own set of challenges — including lack of data transparency and difficulty figuring out where internal responsibility should be for the account as it is significant in sales volume but traditionally viewed as more of a marketing channel. In terms of the weighted averages we found representing brands’ investments into Fresh, 2022 total accrual rates seem to be in-line with 2021. However, there is some shifting in terms of each brands’ level of investment – though, netting out to roughly in-line figures.

Brands expecting ~40% Y-Y growth on Amazon Fresh in 2022:

Looking at 2022, our research suggests brands are anticipating a wide range of growth forecasts for the Fresh business averaging out to roughly 40% year-over-year. Comparing Fresh to the core Amazon.com platform, brands look to be expecting more growth on the Fresh platform as Amazon continues to build out its B&M Fresh store footprint. Some other factors for the varying growth rates across vendors include: 1) Brand maturity on the Fresh platform, 2) Expectations around distribution expansion next year, 3) Spring B&M store resets and working out operational challenges, 4) Evolution of broader supply chain challenges, and 5) Number of new store openings. Brands are also still struggling to figure out a good way to forecast growth given confusion as to whether B&M Fresh sales are baked into online Fresh sales.

B&M stores not meeting vendor expectations:

While the exact number of new stores that will be open in 2022 is unclear, it does seem like the Amazon Fresh team is anticipating the majority of its growth next year to come from new stores vs. same-store sales. We polled our community last week and found that the majority of brands expect only 25-50 B&M Amazon Fresh locations to be open by the end of 2022, slightly below what we have found in our broader research. We continue to hear Amazon’s plans to expand into new markets remains limited as the company is mostly focused on growing within existing markets where it already operates. We believe this is another indication of Amazon placing a premium on execution rather than chasing growth and that this strategy makes sense especially as the supply chain and labor environment remains uncertain throughout this year. Because of the uncertainty, vendors seem to be taking a measured approach in terms of adding investment dollars for promotion plans in 2022 – especially considering the lack of data given after running in-store promotions.