The consumer’s return to normal; Online shopping habits; The omni consumer

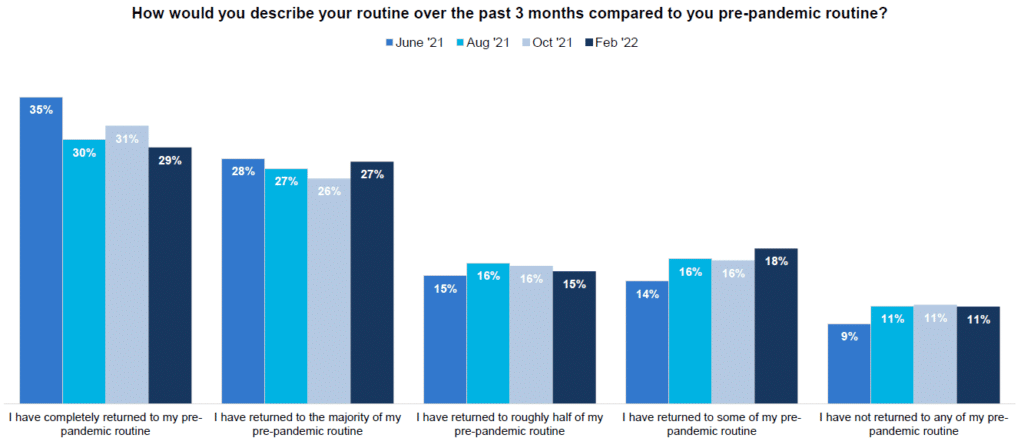

By Cleveland Admin56% of consumers have returned to the majority of their pre-pandemic routines:

In our latest consumer survey, we found that the majority of consumers have returned to their pre-pandemic routine. This is in-line with both our October and August surveys, but less than our June 2021 report, suggesting there has been some disruption along the path to the “new normal.” Across the board, consumers seemed to be mixed on when they expect to be fully back to normal – 22% saying they already are back to normal, 21% saying sometime in 2023+, and 20% saying late 2022. Overall, when asked which routines consumers plan to continue for the next 3-5 years – trying new brands, working remotely, and continuing to make more purchases back in stores where the top 3 routines called out.

1 in 3 consumers shop for groceries online; 1 in 2 consumer shop for general merchandise products online:

In our survey, one-in-three consumers reported shopping online at Target, Walmart and Whole Foods in the last 3 months. It appears that the majority of consumers shopping online for groceries started doing so in 2020 or 2021, however, 53% of consumers started shopping online at BJ’s Wholesale just this year (2022) – a potential effect from the Omicron spike we saw in January. Looking to the future, 30% of consumers reported not expecting to have to change the amount of money they spend on groceries in the next 3 months, while 56% reported thinking they will have to spend more.

In terms of general merchandise purchases, consumers reported shopping online most often on department store and specialty store websites, and Walmart.com in the last 3 months. Again, a lot of consumers began purchasing via online within the last two years, however, consumers reported starting shopping on Amazon more than 4 years ago, suggesting consumers were already relying on Amazon’s convenience prior to the pandemic.

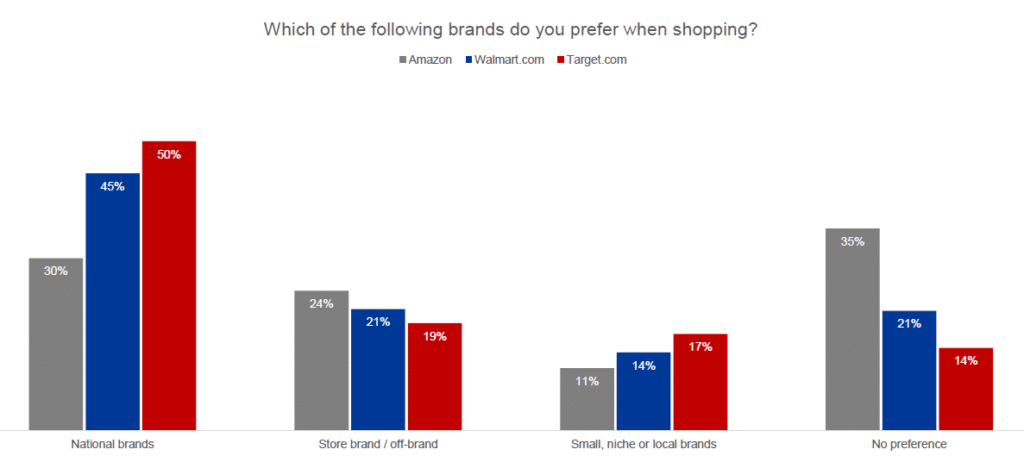

35% of Amazon shoppers have no preference between the type of brand they purchase on the site:

Next week we will be releasing our shopper comparison study, taking a look at how the Amazon, Walmart.com, and Target.com shoppers differ. Within this report, we take a look at who the respective shoppers are and their behaviors while interacting with each retailer. Although we define the 3 categories of shoppers separately, it is important to note that the all consumers are becoming more omnichannel every day and likely shop all three platforms. Creating a holistic strategy for your brand is key to appeal to the “omni consumer”, slightly altering the strategy depending on what shoppers value most from each retailer.

As a preview for the full report, we’ve included one chart below illustrating consumers’ preferences regarding the type of brand they prioritize at each retailer.