Subscribe & Save; Amazon Launches New Beta; Amazon Sales Trends

By Cleveland AdminAmazon Subscribe & Save – Vendor-Funded Manufacturer Coupons:

Our recent Amazon Supplier Benchmark indicated that over 80% of companies using Subscribe & Save (S&S) have run vendor-funded manufacturer coupons on their S&S items, a relatively new offering from Amazon in N. America that is designed to drive S&S penetration. While adoption levels are quite high, performance appears to be more mixed, with the coupons performing below expectations for 35% of brands vs. above expectations for 12% of brands.

New Amazon Beta Allows Brands to Email Shoppers:

Last week CNBC reported a new tool Amazon began piloting called “Manage Your Customer Engagement”, which allows vendors and sellers to send marketing and promotional emails to shoppers who have opted to “follow” their brands, which can be done via store pages, Amazon Live videos, and Amazon Posts. This is a helpful tool for driving engagement, loyalty, and repeat purchases through the Amazon platform, which is increasingly becoming a place for brand building. The tool is free and available to brands in Amazon’s Brand Registry program.

Amazon has had to balance the need for robust tools and features for its vendors and sellers with its desire to keep its data private and hold the reins on customer communications. In December 2020, the company removed the feature that allowed vendors and sellers to respond to product reviews, which was one of the few ways brands were able to communicate with their Amazon shoppers. It was speculated that Amazon would replace that feature with a new customer engagement tool. While Manage Your Customer Engagement is not exactly akin to responding to reviews, the new beta is likely an element of Amazon’s revamped strategy with regards to brand-to-consumer communications.

Source: Sell on Amazon

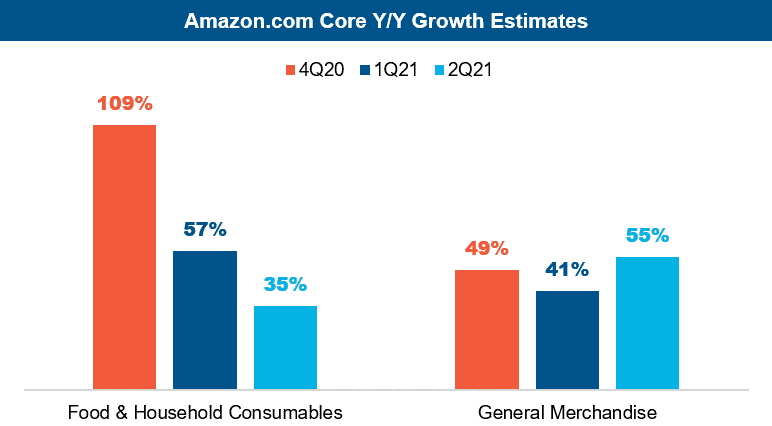

Amazon Sales Growth Trends:

Our latest Amazon Supplier Benchmark suggests a deceleration in food and household consumables categories on the core site in 1Q21, with a further deceleration expected for 2Q. However, the 35% growth forecast for 2Q is on top of the very large sales this category experienced on Amazon during the peak of the pandemic and thus, is better than what many would have expected entering the year. This suggests online demand has remained resilient even as the environment improves. General merchandise categories appear to be seeing less volatile during 1Q, decelerating slightly compared to 4Q. Many general merchandise manufacturers saw their items turned off during 2Q20 as Amazon shifted focus to what it defined as “essential category items.” Manufacturers in these categories can expect an acceleration during the 2Q, with sales expected to rise 55% Y/Y mirroring the high adoption rates of the Subscribe and Save add-on.

Source: CRC Amazon Benchmark, April 2021. n=33 for food & home consumables. n=41 for general merchandise