Stackline Brand Loyalty Data; Amazon Price Increases; Amazon’s 2021 Letter to Shareholders

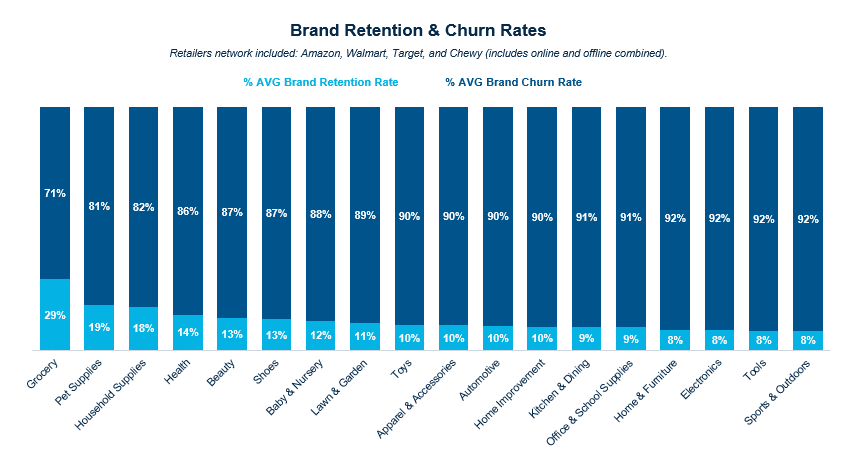

By Cleveland AdminGrocery category seeing highest brand retention rate at only 29%:

Earlier this week CRC hosted our second installment of our 2022 Thought Leader Webinar Series where we were joined by Michael Lagoni, CEO of Stackline. During the session Michael touched on the importance of having a customer-centric strategy to build customer loyalty and retention to win long-term. Stackline believes one of the biggest opportunities in retail is to sell more product to current customers, especially in an environment with rising customer acquisition costs. For context, Stackline shared the above chart highlighting how brands have a long way to go as the majority of categories’ customer retention rates hover around ~10%, meaning 90 of 100 customers will not buy from the same brand within the next 12-24 months after their initial purchase!

Data Definitions:

Retention Rate: % of a brand’s consumers who make two or more purchases with the brand across the retail network (includes online and offline).

Churn Rate: % of a brand’s consumers who make one purchase with the brand, but never return to make a second purchase with that brand across the retail network (includes online and offline).

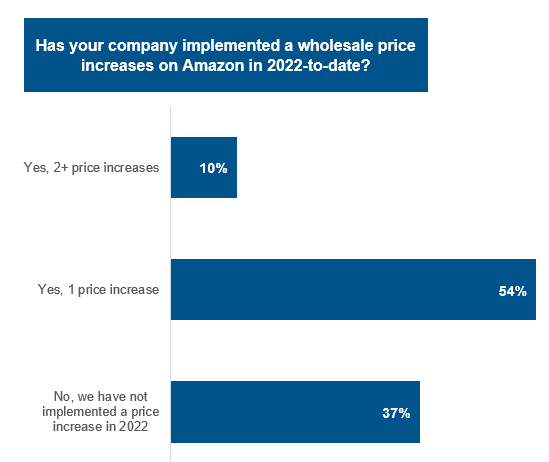

64% of brands have passed price increases on Amazon in 2022-to-date:

In our latest supplier benchmark we have found that 64% of brands have already successfully passed price through to Amazon in 2022, with 10% having increased price 2xs or more. The weighted average of the price increases appear to be in the 7-8% range, which is larger than the 5.5-6.5% average increase we saw in Fall of 2021. More to come on this topic and others as our full benchmark results will be published in the coming weeks.

Highlights from Amazon’s 2021 Letter to Shareholders:

Amazon’s CEO, Andy Jassy, released his first annual 2021 Letter to Shareholders. Below is a few quotes that stood out to us, and our interpretation on what they could mean for Amazon’s future:

- “We realized the equivalent of three years’ forecasted growth in about 15 months.”

- CRC’s Take: Amazon’s annual North American core retail growth expectations are in the 10-15% range.

- “Delivering a substantial amount of shipments in one day is hard (especially across the millions of items that we offer) and initially expensive as we build out the infrastructure to scale this efficiently. But, we believe our over 200 million Prime customers, who will tell you very clearly that faster is almost always better, will love this.”

- CRC’s Take: This is a continuation of a theme the company discussed on its last earnings calls when the management team emphasized a return to pre-pandemic delivery times. We believe Amazon’s refocus on 1-day shipping is a competitive risk for other retailers.

- “Fast forward to the end of 2021, we had 253 fulfillment centers, 110 sortation centers, and 467 delivery stations in North America, with an additional 157 fulfillment centers, 58 sortation centers, and 588 delivery stations across the globe. Our delivery network grew to more than 260,000 drivers worldwide, and our Amazon Air cargo fleet has more than 100 aircraft. This has represented a capital investment of over $100 billion.”

- CRC’s Take: Amazon has built out a logistics network unmatched by peer retailers allowing Amazon to fully control the customer experience. In addition, highlighted by this morning’s announcement of Buy with Prime, its logistical capabilities allow Amazon to compete more directly with Shopify by offering offsite merchants Prime fulfillment benefits. Also, this puts Amazon into even more direct competition with FedEx and UPS.

- “Iterative innovation creates magic for customers. Constantly inventing and improving products for customers has a compounding effect on the customer experience, and in turn on a business’s prospects. Time is your friend when you are compounding gains. Amazon is a big company with some large businesses, but it’s still early days for us.”

- CRC’s Take: Vendors need to build Amazon teams with the aptitude and freedom to iterate and experiment. Finding new ideas and small solutions that don’t necessarily have a high ROI near-term but will clearly compound long-term is the key to success on the platform.

- “It’s safe to say that every one of our devices, whether you’re talking about Kindle, FireTV, Alexa/Echo, Ring, Blink, or Astro is an invention-in-process with a lot more coming that will keep improving customers’ lives. / While there is so much progress in Prime Video from where we started, we have more invention in front of us in the next 15 years than the last 15.”

- CRC’s Take: Audio and video present a both near and long-term opportunity for our vendors to invest in and experiment with in terms of sales, marketing, and advertising content.

- “Our injury rates are sometimes misunderstood…We want to be best in class. When I first started in my new role, I spent significant time in our fulfillment centers and with our safety team, and hoped there might be a silver bullet that could change the numbers quickly. I didn’t find that…we still have a ways to go, and we’ll approach it like we do other customer experiences—we’ll keep learning, inventing, and iterating until we have more transformational results. We won’t be satisfied until we do.”

- CRC’s Take: The combination of hiring/retaining quality warehouse and last-mile workers as well as managing with the developing unionization of its workforce across the U.S. will be top priorities for senior leadership in the coming years.

Subscribe to 3 Things Weekly email

*all fields required