SIOC Update, One Tap Reviews, Amazon Advertising

By Cleveland AdminSeveral members of our eCommerce Council emailed us recently asking if we had heard of Amazon updating the SIOC requirements. Our understanding is that most members with non-sortable products have received communication from Amazon indicating the specs that determine if an item is “eligible for the chargeback” are moving from 9” x 6” x 0.375” to 6” x 4” x 0.375”. Most manufacturers we’ve communicated with on this topic seem a little confused on what this means for their specific catalogues and are trying to reach out to Amazon to better understand the exact ASINs impacted. Manufacturers have until August 2020 to meet the new requirements according to the communication.

When Amazon made a bigger push on SIOC starting about 18 months ago, we expected two things to occur – a shrinking in size of what products would be pushed into the program (which the latest update involves) and more of Amazon’s rivals implementing similar requirements (has not yet occurred to a large degree). Manufacturers should work to understand the exact impact to their catalogues, and much like the first wave of SIOC requirements, analyze at an ASIN-level the economics of shifting to new packaging vs. paying the $1.99 fee.

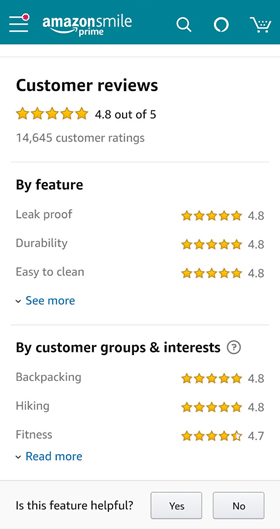

Amazon Introducing One Tap Ratings

A recent report from Recode indicates Amazon introduced one-tap ratings for products late last year in an effort to make it easier for consumers to review products. This is likely an effort to drown out fake reviews which have become an increasingly large problem on the platform and which could limit consumer confidence in Amazon’s recommendations. We view this as an important effort by the eTailer, as lack of consumer confidence in reviews and/or product quality is, in our opinion, the greatest threat to its continued growth.

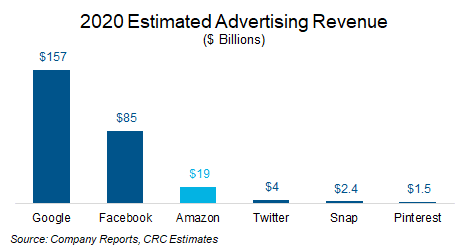

Amazon Advertising Forecasts

Advertising plays a critical role in Amazon’s business as it provides the eTailer with a high margin revenue stream that can help offset the challenging economics of shipping items to consumers’ homes in one day. We are projecting Amazon’s advertising business to grow ~35% growth in 2020, (vs. 39% Y/Y 2019). This compares to Google’s estimated advertising business of $157B in 2020 (growing 18% Y/Y) and Facebook’s at $85B (growing 22% Y/Y). Thus, there is still a long way to go for Amazon to make a larger dent in these other platforms’ dominance. In addition, Google and Facebook properties like Instagram, are increasingly looking to break into commerce, although the impact of these efforts has been relatively minimal to date.