Shift to Online; Ad Revenues Falling; Amazon Winning Share

By Cleveland AdminOur consumer study published earlier this week suggests consumers are moving more purchasing online as they are stuck at home. According to the study, consumers are planning to increase online purchases 20%, making 49% of their purchases online over the next 30 days (vs. 41% over the last 30 days). While this shift is happening across all consumer categories, grocery categories in particular, have seen a major boost online. For example, the results suggest a 41% increase in consumers planning to use delivery to the home for their groceries, benefiting platforms like Instacart, Shipt and Amazon Fresh.

Advertising Revenues Falling Despite More Traffic

This week, Twitter, The New York Times, and Facebook all noted that despite increased usage across their platforms, ad revenues were falling as advertisers cut back on spending due to the coronavirus panic. Twitter noted that it no longer expected to meet provided guidance, the NYT announced that ad revenues were likely to drop in the mid-teens Y/Y during 1Q, and Facebook said that they have “seen a weakening in our ads business in countries taking aggressive actions to reduce the spread of COVID-19”. Other advertising platforms such as Google and Amazon have not provided any update on their business, however our research has indicated that Amazon may be seeing declines in CPCs as some 3P sellers run out of stock and larger 1P manufacturers consider cutting back as they face higher risk of going out of stock and the reduction in conversion from Amazon pushing out shipping dates.

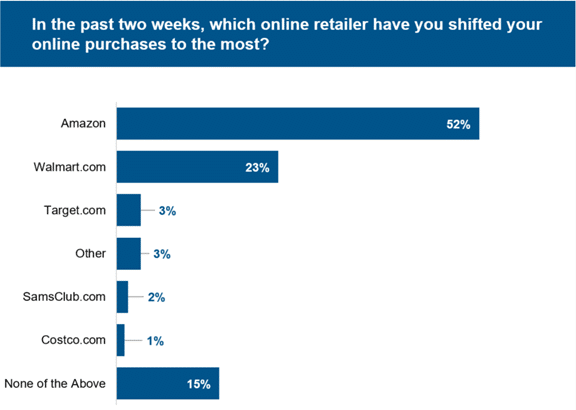

Amazon Big Winner in Online Shift

Our consumer study indicates that more than half of consumers have shifted the biggest portion of their online purchases to Amazon, followed by Walmart. Additionally, a net 53% of consumers have increased their purchases from the eTailer and a net 63% are planning to do so in the next week. The biggest challenge for Amazon will be to keep its service levels high. Many consumers have seen delivery times extend first into late April, and in some cases all the way into June.