Rising 2020 Forecasts; Instacart Expands; US Ranks Second for Relief Packages

By Cleveland AdminForecasting the remainder of the year is challenging considering the duration of the COVID-19 crisis seems to stretch out further each month. In addition, it remains uncertain the degree to which new shoppers now prefer online channels to B&M channels. That said, many manufacturers have increased their 2020 growth plans on Amazon, many by more than 10 points of growth. According to our most recent study, 71% of essential manufacturers and 25% of non-essential manufacturers have now increased their 2020 Amazon forecasts. The non-essential figure has moved meaningfully higher over the last two months as Amazon reduced expected delivery times, thereby helping conversion rates. However, there is still room for delivery time improvement and corresponding conversion rate improvement, so we expect to see more manufacturers raise their forecasts after the month of June.

Instacart Expands

Staples announced it established a partnership with Instacart for same-day delivery from over 1,000 US stores. Retailers without curbside pickup or delivery capabilities are increasingly looking to Instacart to help meet consumers’ new shopping preferences, as the platform has seen order volume grow more than 500% during the crisis. Instacart indicated in the announcement that an opportunity now exists to help get office supplies directly to the home given more people are working from home as a result of the coronavirus. Beyond additional retail partnerships, Instacart has leveraged this new level of demand into a recent $225mm investment round, valuing the technology platform at $13.7B, up from $7.9B in its previous round of funding.

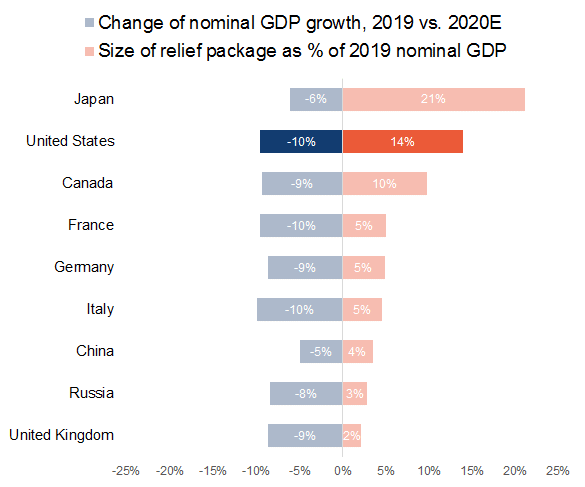

Source: IMF, Cleveland Research Company, Note: The numbers exclude large “public guarantees” that are employed by European countries

U.S. Ranks Second in COVID-19 Relief Package

In response to COVID-19, the U.S. issued larger immediate relief from the CARES Act compared to other countries stimulus efforts, ranking 2nd when comparing the size of relief packages as a % of GDP. Although the nominal value of relief packages is larger than the estimated GDP decline, it does not mean that the packages compensate for all GDP loss. The actual output created by the packages would be smaller than the budgeted amount because some of the money will be saved rather than spent. Penn Warton Budget Model estimated that the 2020 2Q GDP decline was reduced from 37% to 30% (annualized) due to the CARES Act. Direct payment from the CARES Act boosted consumer income by 14% in April and was primarily a short-term boost to spending on durable goods. Approximately 90% of the direct payment had already been distributed by the end of May, and the $600 extra weekly unemployment benefit will expire on July 31, suggesting household income likely faces challenges in 2H without a second round of stimulus checks.