Retail Media – Current Investments & Funding; External Partners

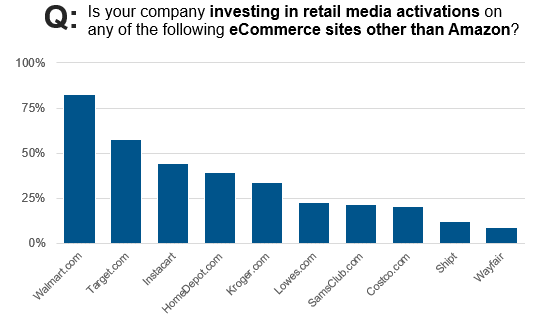

By Cleveland Admin83% of brands are investing in retail media on Walmart.com:

Over the last 2 years, we have seen a proliferation in retail media platforms as many large retailers have invested significantly to capture the higher growth, above-average profitability, and captive consumer base that come from these platforms. As there are more options for advertising, brands are continuing to diversify their retail media investments to other platforms besides Amazon. Across categories, we found in our Retail Media Organizational Benchmark that 83% of brands are investing in Walmart.com, 58% in Target.com, and 45% in Instacart. Breaking it down by macro category, we see that Walmart.com remains #1 for all brands surveyed, but that Target.com and Instacart are the other top accounts for Food & CPG brands, whereas HomeDepot.com and Lowes.com are further up on the totem pole for General Merchandise brands.

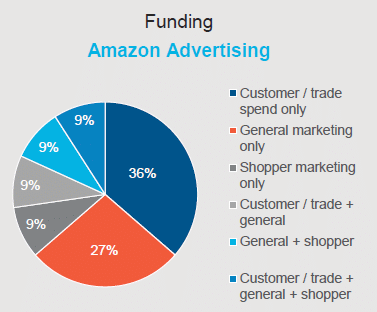

How brands are funding Amazon & non-Amazon retail media investments:

In our research we found that the top way to fund Amazon media investments is through a general marketing budget (for 59% of brands). The same goes for non-Amazon retail media, with 49% of brands funding through that same budget. However, often times brands pull from a variety of sources. In terms of Amazon Advertising, brands surveyed reported 6 combinations (between general marking, customer/trade spend, and shopper marketing budgets) they use to fund the platform. It’s a simpler story for non-Amazon retail media, where brands surveyed reported only 4 combinations.

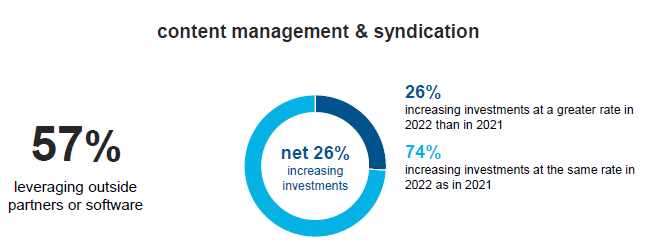

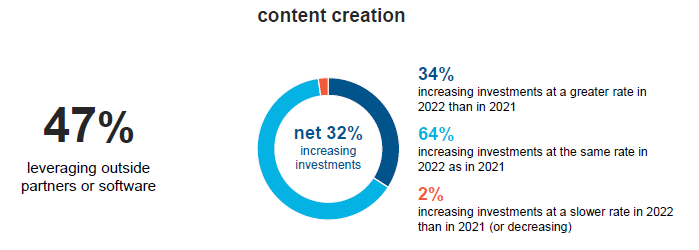

Brands’ 2022 investment plans in external partners:

Our data suggests Content Creation and Content Management & Syndication are the top areas where brands plan to invest more into their partner compared to 2021. We also see many brands planning to lean into partners more this year for Data & Analytics, Brand Protection, and Shortages & Chargebacks Solutions. Full-Service Rep Support (for non-Amazon accounts), eCommerce Fulfillment, and eCommerce Packaging are expected to see the lowest level of growth this year, with eCommerce Packaging being the only area where a net percentage of brands plan to decrease their investments in 2022 relative to growth in eCommerce units.