Renewed Focus on Drop Shipping; Amazon Summer Sale; Walmart Digital Mix

By Cleveland AdminOur research indicates a significant uptick in drop shipping as eTailer capacity constraints and inefficiencies have limited the ability to fulfill demand. Many vendors are proactively increasing their drop ship activity to minimize supply chain issues and better serve demand. In addition, Walmart and Costco have more recently been approaching vendors looking to understand their drop ship capabilities as means towards improving in-stocks and margins. Many brands also indicate an uptick in their direct-to-consumer business as consumers are desperately seeking product that is in-stock and can be delivered quickly. As manufacturers work through the long-term implications of COVID-19, drop shipping and other supply chain capabilities are appearing high on the priority list of investments to accelerated.

Amazon Summer Sale

Amazon recently announced its plans to host a “summer sale” starting on June 22. The event appears to be focused on fashion and apparel and is expected to last from seven to ten days. This is perhaps part of a larger effort by Amazon to take share in the space as department stores continue to struggle in light of recent circumstances. Meanwhile, many manufacturers continue to be kept in the dark on Amazon’s Prime Day plans, with most recent media reports suggesting the event will take place in September.

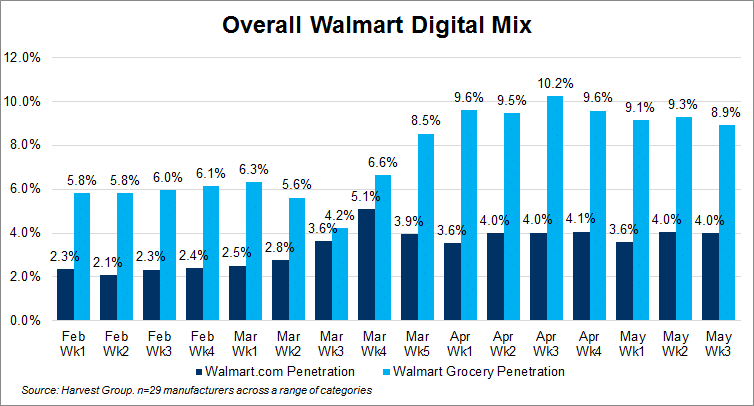

Walmart Digital Mix

One of the biggest questions on manufacturers’ minds is how long digital sales will continue their outperformance. Walmart’s eCommerce business, in particular, has been a major beneficiary from the COVID-19 crisis, with its digital sales growing 74% Y/Y last quarter. According to the latest data from our partners at Harvest Group, Walmart.com penetration is trending at approximately 4% of total sales in May, compared to 2-2.5% in the weeks leading up to the crisis and 5.1% at peak in late March. Walmart pick-up and delivery (previously known as online grocery pick-up) appears to be trending at ~9% of total sales for the retailer, compared to 5.5-6% prior to the crisis and 10.2% at peak in mid-April. In our research, we continue to hear feedback from the manufacturer community that online performance across customers remains very strong, even as states loosen restrictions. We expect the likelihood of digital platforms retaining new online shoppers to increase as the crisis (and therefore use of these platforms) extends further and further.