Prime Day Perspective, Amazon Brand Registry, & Macro Outlook

By Cleveland AdminPrime Day Performance Appears to Have Exceeded Expectations:

Based on our conversations with brands over the last week, Prime Day looked to perform above expectations for the majority of vendors. Some of the outperformance seemed to be due to more modest expectations going into the multiday event as there was real anxiety and concern around consumer health and macroeconomic instability. Instead, site traffic looked to be strong with consumers responding well to promotional and discounting activity. Feedback indicated there was pent-up demand for deals resulting in a stronger lift on promoted items which was partially offset by less of a halo benefit for non-promoted items. For some vendors, it was the first time items were being promoted in ~3 years. These deals were also combined with better product availability leading to greater breadth and depth of discounts for many product categories. Specifically, categories such as household essentials and personal care stood out as being winners while some historical Prime Day winners performed more in-line. Lastly, Amazon’s fulfillment execution (1-& 2-day shipping) was credited for driving a strong promotional event as the company has invested meaningfully in its supply chain. The next few weeks will determine how much of the demand was pull-forward vs. incremental which, for many brands, will then determine the promotional cadence and calendar for the back half of 2022. In short, our viewpoint suggests Prime Day success was driven by: 1) favorable customer response to discounting, 2) better product availability, 3) Amazon execution, and 4) strong site traffic.

Amazon Brand Registry report:

Last week, we published a report highlight features, use cases, and challenges regarding Amazon Brand Services specifically focusing on its Brand Registry program. The report centers around the content, counterfeit, copyright, and catalogue solutions of Brand Registry. Within the report we cover verification processes for brands including Catalogue Lock (helping Vendor Central view your vendor account as the “owner” of the catalogue) and Single Phase Reconciliation (having Amazon recognize your Vendor Central account as the content owner of certain ASINs).

We review some of the most common uses for BR today including PDP mutations, patent violations, and IP infringements. In addition, we look at common hurdles brands are facing today as well as answer questions such as:

• Do we need a full-time internal hire working on brand protection? If so, where do they fit within the organization?

• Can brands seamlessly push content/catalogue changes through Brand Registry?

• What is Amazon’s definition of “counterfeit” or even “brand protection”?

Macro update – inflation, labor market, consumer spending, outlook:

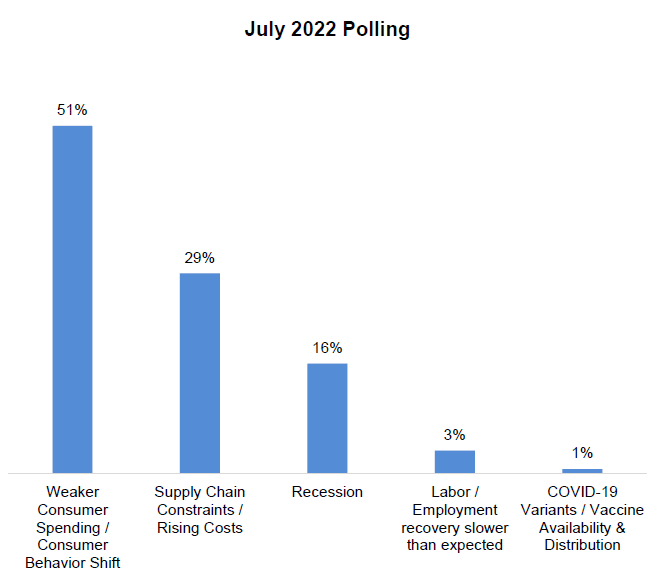

Last week CRC’s Macroeconomic Research team hosted a webinar on the state of the economy. At present, the team estimates that we are in very late stages of the economic cycle. Core inflation has seen signs of easing recently, but the impact from gas prices and food prices remain constant. COVID-19 also remains a disruption threat as supply chains remain fragile and another outbreak in the fall/winter could further the demand / supply disparity with increased loss of production. Despite households in a generally healthy financial position, consumer sentiment is becoming increasingly negative with more anxiety-inducing recession headlines being released. Accordingly, 51% of brands also see weaker consumer spending as the biggest risk to their businesses over the next 12-24 months.

Below is a SWOT analysis of the macroeconomic landscape the team provided on the webinar:

• Strengths

– At full employment

– Healthy consumer balance sheet with low debt level

– Plenty of liquidity in the financial system

– Businesses are sitting on large earnings from previous 2 years

• Weaknesses

– Inflation remains sticky

– Both fiscal and monetary policy will continue to be contractionary

– Low-income group are exposed to the highest health and financial risk

– Corporate margins are likely getting squeezed soon (if not already)

• Opportunities

– Permanent shift of consumer behavior creates new demand

– U.S. likely not face the most “4C’s” challenges among competitors

– Increasing interest rate may attract foreign direct investment

– Stable inflation environment after recession could spur longer economic prosperity

• Threats

– Other more transmissible/deadly COVID variants that could cause wide lockdown

– Recession lasts longer / broader / deeper than expected

– Geopolitical tensions escalate