Prime Day investments, Amazon’s fall promotional event, B&M foot traffic

By Cleveland AdminFood & CPG Brands pulling back for Prime Day this year:

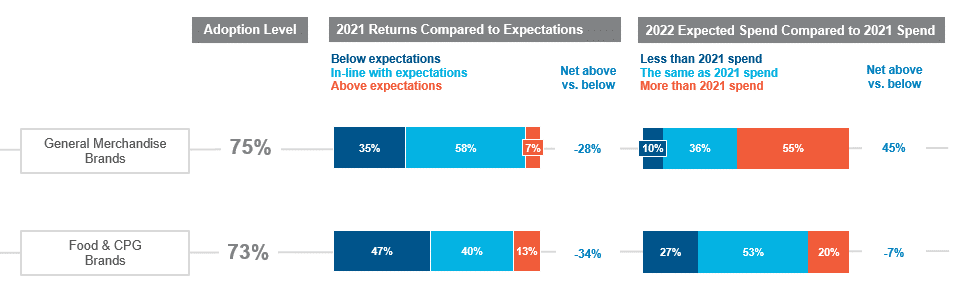

In terms of the July sales event, our latest insights indicate that a net 7% of Food & CPG brands plan to spend less on Prime day in 2022 than in 2021. Conversely, a net 45% of General Merchandise brands plan to spend more than 2021 on Prime Day. This push comes from Amazon promoting aggressively to compete with other B&M retailers this season. Also, driving this participation amongst General Merchandise brands is improved product availability compared to last year. For General Merchandise brands are leaning in, we are hearing it is most commonly for their top sellers or new items. Nearly all brands (regardless of category) still keep search budgets ramped around this time period to capitalize on the increased traffic. Overall, vendor feedback suggests the event is expensive for the upside realized, limiting the excitement around the multi-day event.

Amazon’s fall Prime Day-like event:

As published in our report on Amazon last week, we anticipate Amazon running another Prime Day-like event in late September / early October. This will help Amazon compete in an intensifying retail landscape as we see peer retailers increasing their markdown activity. Additionally, this will likely help pull forward early holiday demand as well as help the company’s topline momentum as it laps over ‘Epic Daily Deals’ that ran most of October 2021 and Prime Day in October of 2020. The categories participating in this multi-day event appear broad-based, and, in some instances, we are hearing of planned deals more significant than Prime Day in July. At this point, it is unclear how Amazon will market this event to consumers.

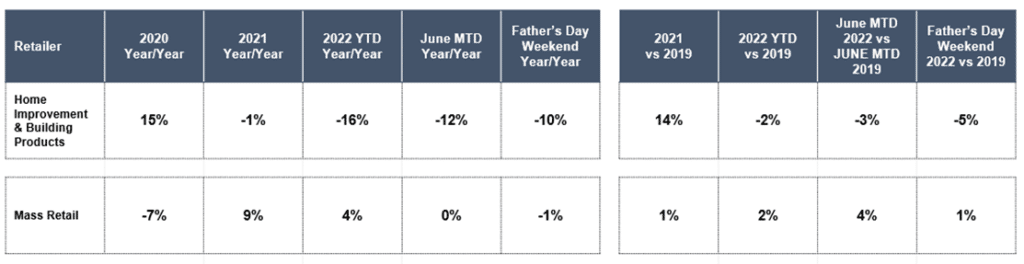

Home Improvement and Mass Retail foot traffic negative over Father’s Day weekend:

Father’s Day weekend traffic (defined as a 7-minute visit to a brick & mortar store) was below the year ago period for Home Improvement Retail (down 10%) and Mass Retail (down 1%), highlighting the increasingly challenging near-term retail / consumer spending environment. Even compared to 2019, Home Improvement Retail traffic was down 5%, and Mass Retail traffic was nearly flat. Home Improvement Retail traffic levels have continued to lag pre-pandemic levels in June, with traffic over the last 4 weeks just slightly below 2019 (but closing the gap vs 2019 compared to April and May). The year-to-year traffic gap (2022 vs 2021) has narrowed this Summer (May/June) after the considerable gap in the Spring as the channel lapped an outsized benefit from stimulus-aided sales from last year and favorable Spring weather (last year).