Prime Day; Amazon’s Partnerships with Kohl’s and Toys R Us; eCommerce Growth Forecasts

By Cleveland AdminWe expect the holiday shopping season to kickoff early this year, as Prime Day is expected to run in mid-October and Amazon’s competitors are following suit with holiday-type promotions planned to start earlier than normal (Home Depot the most recent example). We expect the consumer to react reasonably well to a pull-forward in holiday shopping as they look to ensure items arrive on time, given consumers experienced multi-week shipping periods during peak demand spikes in March and April. Our research suggests that Amazon’s Prime Day deals will only be around 15% compared to 25-30% last year. We recommend brands include the event within their overall holiday promotional strategy rather than viewing it as a separate sales event.

Source: Amazon

Amazon’s New Partnerships with Kohl’s and Toys R Us:

In yet another example of Amazon capitalizing on a challenged B&M retail landscape, the eTailer has reportedly entered into new partnerships with Kohl’s and Toys R Us. Following the partnership in which Kohl’s started accepting Amazon returns in its stores, Amazon now has plans to operate its own grocery store within a portion of a Kohl’s store in La Verne, California. These partnerships with Amazon (and similar ones with Aldi, Planet Fitness, and others) are a way to drive new traffic into Kohl’s stores and make its physical footprint more efficient. For Amazon, the partnership offers space for the company to take on its ambitious physical grocery goals without having to invest in a new build. This is one of several Amazon-branded grocery stores currently being developed, and Amazon is looking to leverage distressed retail space for its expansion plans as well.

After filing for bankruptcy and liquidating its stores, Toys R Us is now partnering with Amazon this holiday season. Under the partnership, consumers can browse toys on the Toys R Us website and then redirect to Amazon to purchase. Toys R Us had a similar deal with Target for the 2019 holiday season but that reportedly ended in July. This new partnership with Amazon is an effort to revitalize the Toys R Us brand with the vision of playing a larger role in holiday toy sales again through revamped B&M stores and a more robust eCommerce strategy. While the partnership may not have a huge impact on Amazon’s 4Q sales, we see it as a simple way to take a greater share of legacy Toys R Us shoppers vs. rivals like Walmart and Target.

COVID-19 has put significant pressure on what was already a tough B&M retail environment, resulting in countless store closures and bankruptcies. This creates a “win-win” situation for Amazon as the company takes on both eCommerce and B&M retail, with more consumers coming online than ever before, and also distressed commercial real estate becoming available for Amazon’s B&M ambitions. We can expect Amazon to continue to take advantage of the current environment in unique ways like these new partnerships.

Source: Toys R Us

2020 eCommerce Growth Rate Expected 2x+ Prior Trend:

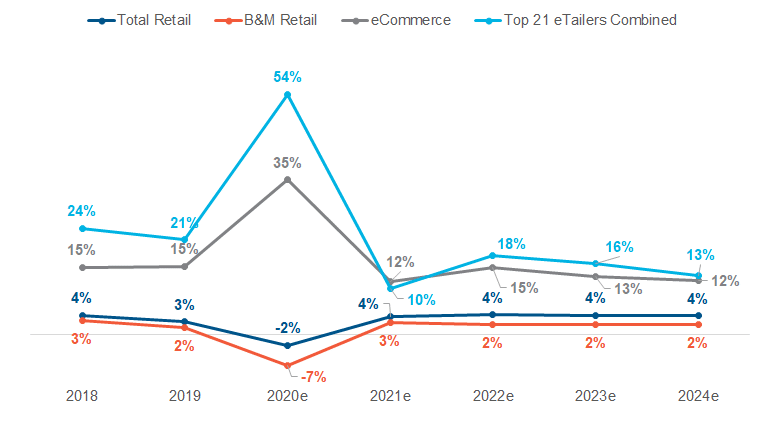

In its most recent release, the US Census Bureau indicated eCommerce grew nearly 45% Y/Y during the second quarter, driven by pandemic shopping behavior. This rate was approximately 3x the annual rate of the last several years, demonstrating just how quickly and materially shopping behavior has changed. Even without a vaccine or improvement in rapid testing capabilities, we expect this type of elevated growth to continue through the first quarter of 2021,. We’ve forecasted total eCommerce growth of 35% for 2020 compared to 15% growth in 2019.

Beyond 1Q21, we expect the Y/Y rates to come down meaningfully from 2020, given more difficult comparisons rather than a major reversal in consumer behavior. While we do expect some percentage of consumers that have been buying online to return to pre-pandemic behavior, all of our consumer research to-date suggests a high degree of retention is likely across a wide range of retail platforms. When we add it all up, this equates to 12% Y/Y growth in 2021 and a return to low- to mid-teens growth in the out years.

Our eCommerce Market Forecasts report covers our growth estimates through 2024 for the total market, individual retailers, online grocery, online home improvement, DTC, and marketplaces.

Source: US Census Bureau, Company Reports, Stackline, Factset, CRC Estimates