Premium A+, Go Grocery, Vendor Negotiations

By Cleveland AdminAmazon has rolled out another form of enhanced A+ content that allows manufacturers to include richer content on their product detail pages. The program, while initially free, is now being presented to vendors in the $500k range to have portfolio-wide access. However, to-date, Amazon has not shared enough data with manufacturers to make the investment case for this level of spend. Most manufacturers we have spoken with on this program are either passing on it or looking to include it as a piece of a broader deal until they have a clearer understanding of the ROI.

Amazon Opens First Go Grocery Store

This week, Amazon opened its first “Go Grocery” store in Seattle. The store represents a further foray into B&M locations for the eTail giant, following prior experiments with Go convenience stores, book stores, and Amazon Four Star stores. The new location uses similar cashierless technology as existing Go convenience stores, but is approximately five times larger at around 10,000 sq ft. and offers a broader selection of food items including fresh produce. Amazon also appears to be likely to launch more grocery concepts in Los Angeles and Chicago. These efforts appear to be in addition to Amazon’s plans to take share in online grocery, through expansion of its UltraFast Fresh (F3) into more markets and removal of additional fees for the service late last year. These Go Grocery stores appear to be supplied through Amazon’s Fresh supply chain, possibly allowing for these B&M locations to work in concert with its online fresh efforts.

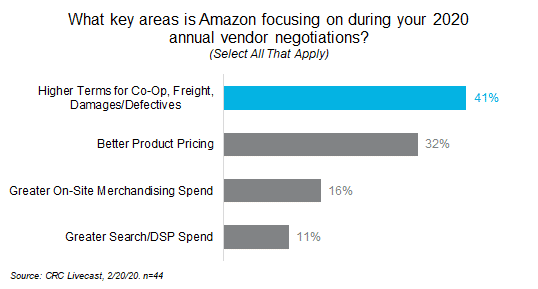

Amazon Vendor Negotiations

While manufacturers like the growth opportunity on Amazon, coming to an agreement on annual terms is always challenging. Our research suggests that while some brands saw Amazon simply renew their terms from last year, most entering annual vendor negotiations (AVNs) have experienced Amazon looking to improve its terms. As the LiveCast polling suggests, the asks from Amazon cut across a range of different areas. The number one area of focus in 2020 appears to be on increasing base terms, including co-op, freight, and damage and defectives. Amazon is also looking for better pricing and to a degree greater on-site merchandising spend. Relative to past years, Amazon’s vendor managers appear less focused on trying to get manufacturers to spend more on search/programmatic. It is believed that Amazon is reducing or eliminating advertising spend from its calculation of core retail profitability, which is leading vendor managers to try to increase investments into other areas.