Post-Pandemic Retention, Costco Holds Off on BOPIS, Holiday Promotional Plans

By Cleveland Admin

We recently surveyed 1,386 general merchandise consumers across seven key online retailers to determine how these retailers are performing, which ones are leading and lagging on different dimensions, and to what degree consumers think they’ll use these eCommerce sites post-pandemic. When considering post-pandemic retention, a net 83% report being comfortable purchasing on these sites, and a net 39% plan to purchase more online next year compared to their current behavior (45% plan to purchase more, 6% plan to purchase less, and 50% expect no changes). Furthermore, when consumers were asked why they’ll use the given eCommerce site for more purchases next year, “saving time” and “convenience” were most often the top one or two reasons, both of which are relatively independent of the status of the pandemic. Conversely, “safety reasons (such as avoiding germs)” was the fourth cited reason, on average. These metrics give us further conviction that future retention looks bright for these eCommerce sites.

Note: Retailers included Amazon, Walmart.com, Target.com, Costco.com, HomeDepot.com, Lowes.com, and Wayfair. N = 1,386 respondents in total, ~350/platform.

Source: About Amazon

Costco Not Planning on Offering BOPIS at this Time:

Costco reported fiscal Q4 results last week, including eCommerce growth of 90.6%, and 120% growth when including the Instacart business. The company also noted “several hundred percent” growth in online grocery, specifically. On its investor call, management stated that Costco does not have immediate plans to offer a “Buy Online, Pickup In Store” option. This is a unique approach as nearly every other large retailer has moved quickly to launch or expand their BOPIS capabilities during the height of the pandemic. While logistics, profitability, and other challenges are valid concerns, we expect Costco to revisit this stance as it will either forego the direct relationship with consumers looking to buy online (Instacart the main beneficiary) or lose share to rivals that do offer this model.

Source: ablokhin/iStock via the New York Times

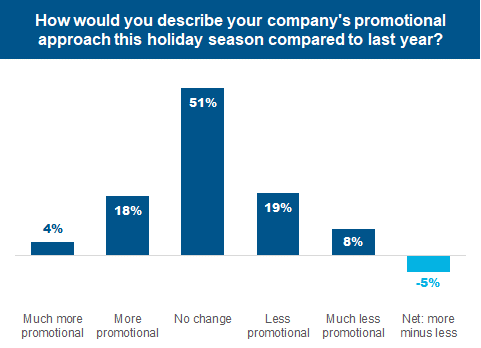

Slight Lean Towards Less Holiday Promotions This Year:

During last week’s LiveCast, we polled the manufacturer community on their promotional plans for this upcoming holiday season. The results suggested a mix of differing plans this year, with a slight lean toward being less promotional, overall. As discussed in the LiveCast, various factors are influencing these plans. Manufacturers that are planning to pull back on promotions tend to be dealing with inventory and supply chain disruptions, making it challenging to meet current demand, let alone additional demand that comes with promoting. Manufacturers that are planning to promote more this year, tend to be looking to invest unused funds from earlier in the year when COVID-19 led to a pause in promotions.

Source: CRC LiveCast, 9/24/20, n=77