Omnichannel & Pureplay Collaboration; Commerce Marketing Growth; COVID-19 Concessions

By Cleveland AdminIn our latest benchmark research on team collaboration, an increasing number of brands are connecting their Amazon teams with their omnichannel teams. This is because emerging omnichannel retailers often model their digital business and strategies after Amazon. About half of these brands hold meetings monthly or more between these two groups suggesting that there is likely an opportunity to improve collaboration. It’s also important to come to the eCommerce (and total retail) market with a holistic strategy. An eCommerce Center of Excellence (CoE) team is one way to foster cross-functional collaboration, and our benchmark shows 42% of brands have an eCommerce CoE, including 47% of eCommerce brands with more advanced digital strategies.

Source: MGM Insights

Commerce Marketing Continues to Expand:

Yet another retailer has unveiled their own advertising offering in attempt to improve margins on their own site and leverage their customer data. Ulta Beauty is reportedly joining the likes of Walmart Media Group, CVS Media Exchange, Target’s Roundel and others in offering search-based and programmatic advertising options. Commerce marketing is a clear example of why team collaboration is so important for eCommerce and overall business success as it blurs the lines between sales and marketing and between digital and brick-and-mortar.

Source: Chicago Tribune

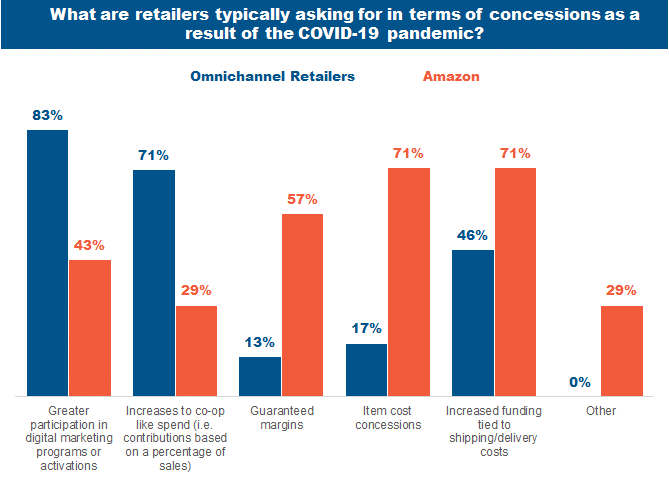

Omnichannel Concessions due to COVID-19: While the outlook for online demand in ’21 is quite positive, brands are beginning to see greater profitability pressure from their omnichannel customers and they expect that to continue into 2021. In our latest supplier benchmark, 52% of brands reported that their omnichannel customers have reached out in the last three months seeking concessions specifically as a result of increased costs tied to the pandemic, with Walmart and Target being the most common examples. Digital marketing spend and increases to co-op-like spend are where brands are most frequently seeing “asks.”

Source: CRC COVID-19 Benchmark, December 7, 2020, n=55