Ocean & Air Costs; B&M Amazon Stores; Online Retailor Survey

By Cleveland Admin

Our research indicates shippers should prepare for ocean and air freight costs to be 100% above pre-COVID levels through 2022 as strong demand (ocean) and capacity scarcity (air) persists. The most notable changes over the past 60 days is the stronger-than-expected demand outlooks (inventory orders) for online retailors and higher-than-expected pricing levels in 2021 ocean contracts, with rates +100% versus prior levels (prior expectation was +75-100%). As a result, key near-term strategies to consider include longer lead times, adding capacity providers (NVO/forwarder/broker), and diversified routings/services in both Asia/US. Longer-term strategies to consider are investments in faster DC/warehouse operations and stricter 8-week order forecasting.

Amazon explores expanding B&M presence with discount stores:

A recent Bloomberg article reports Amazon has plans to open discount retail stores selling a mix of home goods and electronics as a way to move unsold inventory from their fulfillment centers and offer consumers another retail experience focused on favorable pricing. While the pandemic allegedly put these plans on pause last year, we may see the online retailor shift to testing these stores in the future, alongside its continued efforts in building out a B&M presence with its Fresh banner grocery stores. CRC’s consumer research validates Amazon’s B&M ambitions as our data show multi-channel shopping is the norm, with a high level of consumers leveraging a combination of in-store shopping, click & collect, and home delivery.

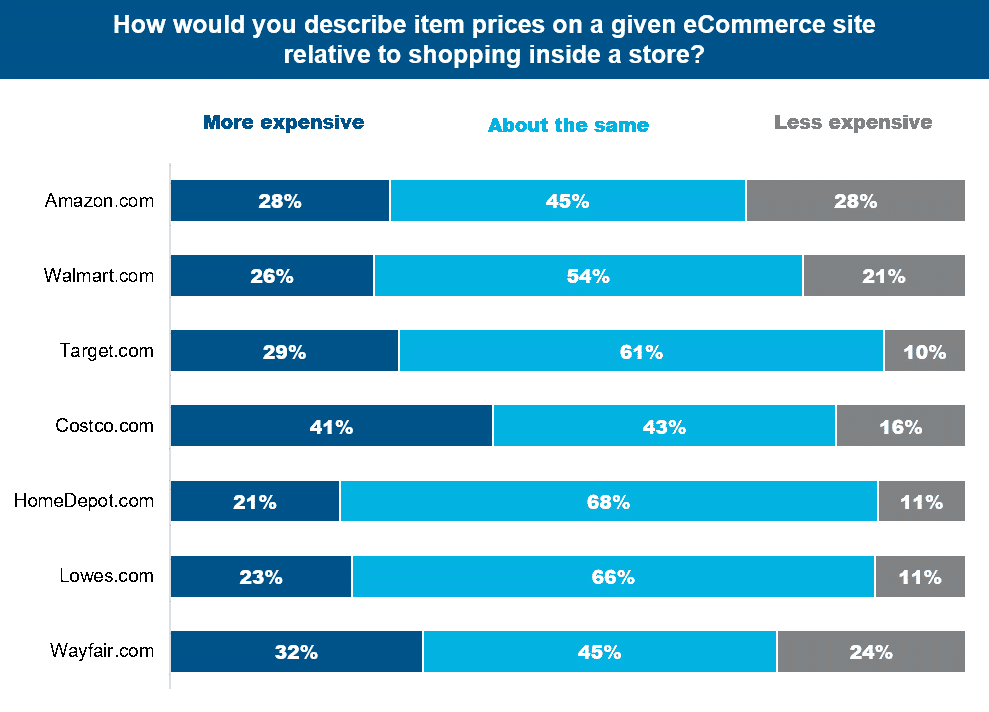

Costco perceived to have the worst pricing online relative to shopping in-store:

We ran a recent consumer study comparing several online retailers within general merchandise categories which showed consumers view Amazon as offering the best pricing relative to shopping inside of stores. Costco.com ranked last in terms of price perception vs. in-store, and these Costco.com shoppers were also the most likely to cite “too expensive” as their rationale for using the site less next year. Target.com also scored poorly on price perception relative to its peers. In order to maintain the online share gains seen over the last year, this data suggests Costco.com and Target.com may need to become more promotional in the back half of 2021 as consumers grow more comfortable returning to stores.

Source: CRC Online Consumer Study, March 9, 2021 N = 1,391 respondents in total, ~350/platform