Marketplaces, Amazon’s Search Algorithm, Ad Spend

By Cleveland AdmineTailers Continue to Look to New Products and Services for Growth and Profitability

Our review of Pure Play eCommerce companies highlighted a continued trend of eTailers introducing new products and services, in an effort to continue to drive growth and improve profitability in a dynamic eCommerce landscape. Many of these offerings emulate what Amazon has accomplished over the past several years, including offering advertising services, private label, payment intermediation, and cloud computing. One notable new initiative came from eBay. Most manufacturers on our eCommerce Council do not currently sell directly on eBay, although their products may end up there from 3P sellers. The eTailer indicated it was going to help identify brands more prominently going forward via its Brand Outlet. While eBay is not expected to grow this year, it does offer whitespace for brands not currently doing direct business on the site.

WSJ Reports Amazon Changed Search Algorithm to Focus on Profit

Amazon has reportedly changed its search algorithm to highlight more profitable items, according to a report from the WSJ this week. The change was reportedly made late last year despite internal opposition from Amazon’s search team, dubbed A9, who argued that the change would result in worse outcomes for consumers. Amazon denied the allegation in a tweet, saying that it had not changed search criteria to include profitability. Our research over the past couple of quarters has pointed to Amazon switching its focus back to growth at the expense of profitability, most notably with it’s move to overnight Prime shipping.

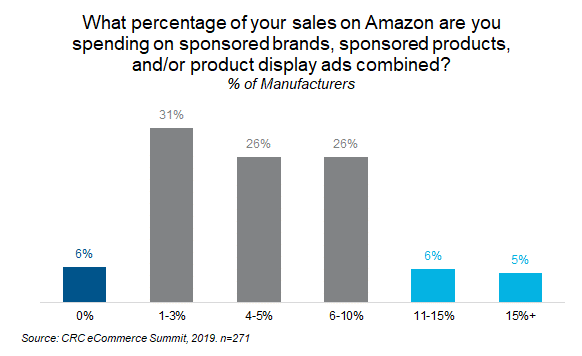

Amazon Advertising Spend

At our eCommerce Summit last week, we asked attendees about their level of investment into Amazon Advertising. While we recognize every company will be in a unique competitive situation, the broad benchmark can be helpful to provide a sense for the level of ad spend that is occurring on the platform. The results suggest 57% are spending 1-5% of their Amazon sales on paid search ad options on the site. Another 26% indicate they are spending 6-10%. These results seem consistent compared to prior years when we would pick up anecdotal comments from manufacturers that they were spending in the mid-single digit range, suggesting a degree of consistency in the level of paid search investment.