Lowe’s Mimicking Store Structure; Bezos is Gone at Amazon; Millennials Still Love to Shop Online

By Cleveland Admin

Our work suggests Lowe’s is working to rearrange its organizational structure to more closely match other big box retailers like Walmart, Target, and Home Depot. Contrary to in the past, online and brick & mortar merchants seem to be aligned on goals versus in competition against each other. These types of changes at the retailer level emphasize the importance of a holistic and collaborative strategy and are leading brands to rethink their own organizational structures as well. This means that brands will be increasingly invested in not just online shopping or in-store shopping, but adapting strategy to cater to both.

Our organizational benchmarking work shows the most popular structure is for omnichannel “dot com” sales leads to report to each individual customer team (60% of brands are structured this way), although mature eCommerce brands are much more likely to have omnichannel leads report to eCommerce instead (34% of mature eCommerce brands vs. 22% for emerging eCommerce brands).

CRC’s Take: No single structure will be right for every organization, and in some cases it may make sense to adopt multiple reporting structures depending on the retailers you sell into. It’s also important to be flexible and willing to adapt the structure over time in order to be best positioned in the ever-evolving retail environment. It may make sense to put more focus into online presence if that corresponds to consumer behavior at the time. Conversely, it may make more sense to focus on B&M presence as consumers expand their comfort levels with in-store shopping post pandemic. As brands consider how to structure for omnichannel success, we recommend reviewing the key discussion questions at the bottom of page 7 of our Collaboration Best Practices report.

Bezos estimates Prime members save 75+ hours per year with Amazon:

Amazon put out its 2020 Annual Report and with it, Jeff Bezos’ (final!) annual letter to shareholders. Each year we find this letter insightful, but what was particularly interesting this year was his analysis of the amount of time Prime members save when shopping on Amazon, as part of his calculation of the total value Amazon creates. The letter discloses that customers complete 28% of online purchases on Amazon in three minutes or less, and half of all purchases are finished in less than 15 minutes. He compares that to about an hour of time spent for a typical, in-store shopping trip, translating to over 75 hours saved per year for the average Prime member.

While Bezos referenced low prices, vast selection, and fast delivery as additional benefits to consumers, he focused his analysis on the time saving element, suggesting it is Amazon’s biggest differentiator. Our general merchandise consumer study supports this, as saving time and convenience were by far the top two reasons consumers cited for increased online shopping on sites like Amazon.com a year from now. The same was true for Amazon Fresh shoppers in our online grocery consumer study. For vendors, this focus on fast shopping trips can serve as a reminder of just how important it is to be at the top of search results with content that converts.

Millennials most likely to discover new brands online:

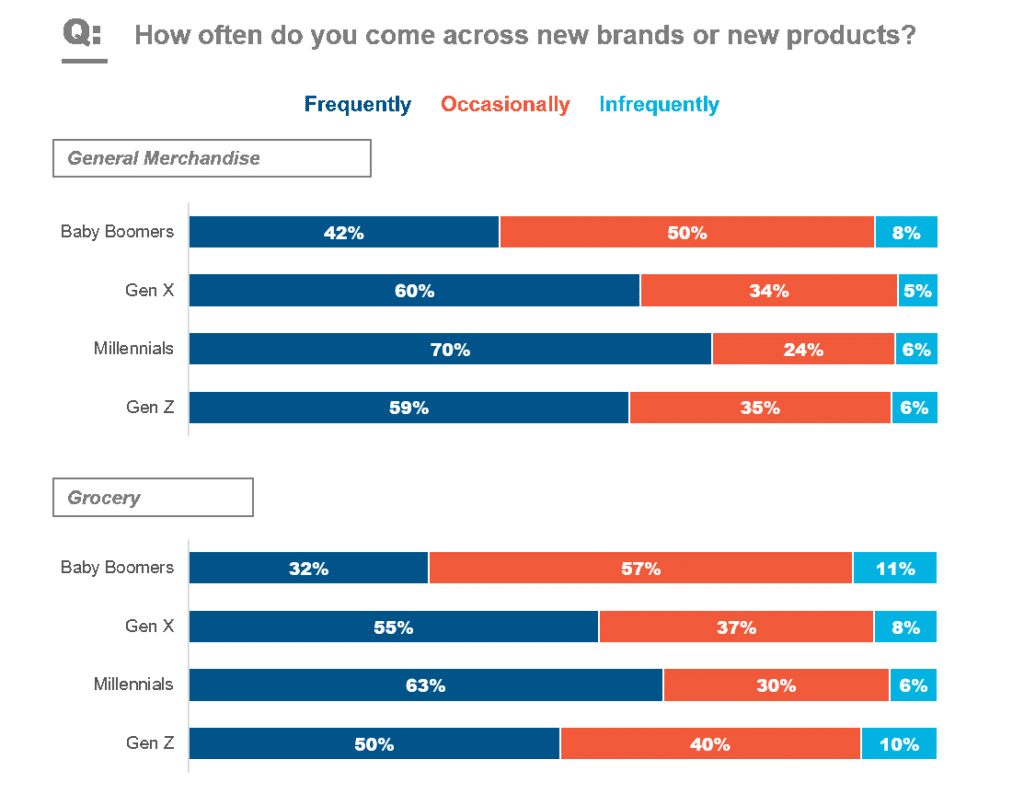

Our generational consumer study shows millennials are most likely to discover new brands or products when shopping online for both grocery and general merchandise categories. Millennials are 10+ points more likely than other generations to frequently discover new general merchandise brands or products, and 8+ points more likely in grocery categories. This is likely driven at least in part by the cohort’s propensity for browsing while online shopping, as they are also the most likely generation to browse in both macro categories.

Source: CRC Online Consumer Study, March 9, 2021, N=1,391 respondents total and CRC Online Grocery Consumer Study, March 3, 2021, N=1,086 respondents total