Jeff Bezos’s Transition; Walmart Connect; Amazon 4Q Results

By Cleveland Admin

Amazon announced this week that Jeff Bezos would be transitioning from CEO to Executive Chairman, passing the baton to Andy Jassy, long-time CEO of Amazon Web Services. Based on reports, Jassy is a well-respected executive at Amazon, essentially starting and leading the industry-changing AWS business, which some estimate would be valued at over a trillion dollars if it were a stand-alone business. Jeff Wilke’s announced departure last year, along with additions to Amazon’s executive team at that time, combined with an insider assuming the CEO role, all suggest a very thoughtful transition plan being executed. We do not expect the CEO transition to impact manufacturers doing business on Amazon’s retail platforms for 2021 (the transition will not occur until 3Q21), and we would be surprised to see much of any impact even into 2022. However, we will be closely monitoring what strategic areas Jassy focuses on and the degree to which he changes the executive ranks of the retail organization as he takes over.

Andy Jassy, incoming CEO of Amazon

Source: CNET

Walmart announces the next iteration of its commerce marketing platform: Last week, Walmart announced the rebranding of its advertising platform, Walmart Media Group, to Walmart Connect. This rebranding will expand offerings to include the addition of in-store placements via TV walls and self-checkout, more placements across Walmart.com and Walmart OPD, and off-site placements through a new demand-side platform (DSP) with The Trade Desk.

Walmart followed up this news with another announcement: it has acquired Thunder Advertising Technology, a creative automation ad-tech company. With this, suppliers will have access to a display self-serve platform to activate and manage campaigns quicker, more easily, and with more control. Walmart indicated the self-serve platform will be available to suppliers later this year. This is the type of announcement many brands have been waiting for, as our research suggests the manual nature and poor reporting of Walmart’s existing advertising platform has limited ROI and has been a pain point for those managing the campaigns. Solving these issues and expanding to off-site will likely result in Walmart capturing more of brands’ marketing budgets.

It’s important to note the technology acquisition that was required for Walmart to take its advertising business to the next level, as this space continues to become more robust, complex, and fast-moving. While Amazon has led the way with its powerful technology, retail competitors like Walmart are following suit. According to our Amazon Teams Benchmark, a third of all brands manage their campaigns on Amazon with the help of an external partner specializing in Amazon Advertising, and many of these partners have robust technology and data capabilities to maximize efficiency and effectiveness. Over the next few years we expect these partnerships to become more common and to expand to encompass other commerce marketing platforms outside of Amazon, such as with Walmart Connect

Source: Walmart

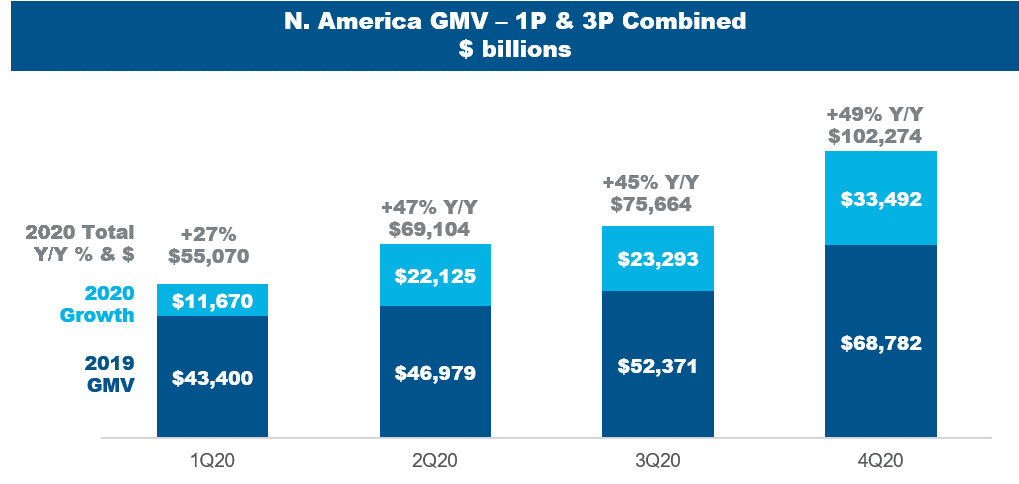

Amazon Grows N. America GMV by $33B+ in 4Q20:

Amazon surpassed $100B in N. America GMV (a measure of total goods sold on the platform) during 4Q20, generating a staggering $33B+ in incremental growth compared to 4Q19. Its growth rate in N. America and International accelerated during the quarter, benefiting from the shift in Prime Day to 4Q and greater online buying behavior in Europe resulting from lockdowns imposed as a result of CV-19. The company indicated it feels positive on 2021 even as the pandemic is likely to lessen in severity. Amazon’s Prime membership base grew throughout 2020, and these new members are engaging in a wide range of Prime member benefits, such as Prime Video. Its 1Q21 guidance aligns with this positive outlook, suggesting the company is off to a solid start for the year.

Source: Company Reports; CRC Estimates

Note: GMV is Gross Merchandise Value, or the total value of goods sold on Amazon. This amount does not equal revenue as Amazon only recognizes a portion of each 3P sale that occurs.