Instacart Activations; Kroger eCommerce Profitability; Consumer Holiday Shopping Plans

By Cleveland AdminOur latest research on Instacart suggests brands should first turn to Featured Products (i.e. paid search) with their activation budgets, maximizing that spend before moving to other activations. This is analogous to how many brands have approached their paid activation strategy on Amazon. Our consumer research shows search remains the top shopping behavior for online grocery, with 81% of Instacart shoppers using search to find their items.

Improvements to Instacart’s paid search program coupled with the surge in demand has led to greater competition and therefore rising CPCs over the last few months, although return on ad spend remains favorable. Our research suggests mixed feedback on Instacart’s other activations: delivery promotions, coupons, and hero banners.

Source: Getty Images via USA Today

Kroger Focused on Improving eCommerce Profitability:

Kroger reported 2Q results last week, including digital sales growth of 127% (up from 92% in 1Q). eCommerce profitability was a big focus of the company’s earnings call, and management noted digital sales growth was profitable on an incremental basis due to online customers spending more, a reduction in cost of orders, and growing digital media revenue. Digital transactions are still lower margin than in-store but the company sees a path to further improve eCommerce profitability to a point where it one day matches in-store profitability. Improving the sales mix through personalization, opening up a marketplace, continuing to find fulfillment savings and growing its digital media business were the key drivers that management called out.

Due to the meaningful shift toward digital driven by COVID-19, omnichannel retailers like Kroger are tasked with growing profitable eCommerce businesses. According to our most recent supplier benchmark, 39% of manufacturers are already being approached by customers for funds to offset increased costs related to the mix shift. Target and Walmart are the main culprits as of now, asking for increases in co-op-like spend and greater participation in digital marketing programs. Because of this, manufacturers will need to reconsider their financial planning and activation strategies on these accounts for the remainder of the year and into 2021.

Source: Bloomberg via Getty Images

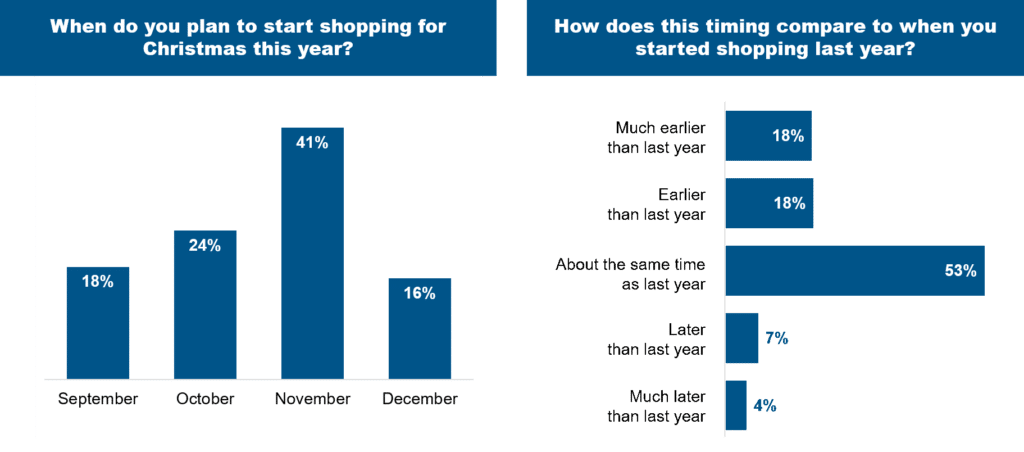

Consumers Plan to Start Holiday Shopping Early this Year:

Our latest consumer survey verifies that nearly 40% of consumers plan to start their Christmas shopping earlier than last year. This is at least partially driven by concerns on online order delays as 75% reported being at least somewhat concerned. Our research suggests we can expect a similar in-store/online shopping mix that we’ve seen throughout the pandemic thus far, with 25% planning to have the majority of their holiday items delivered, 8% planning to buy online and pick up in store, and the remaining 68% planning to shop in stores.

Source: CRC Consumer Survey | September 2, 2020