A Sneak Peek at Holiday 2021 for eCommerce Professionals

By Cleveland AdminIt seems like every year the holiday season comes around earlier and earlier, and so far, 2021 is no different. Our research from the supplier community suggests this year’s season will be even more elongated due to supply chain challenges such as inventory delays and high shipping costs. Our real-time consumer survey data supports this, as 43% have already started their holiday shopping, with 57% of those consumers reporting shopping earlier this year compared to the 2020 holiday season. The primary reasons cited for this behavior shift include supply chain concerns, better deals/lower prices, and COVID-19 precautions (like crowd control).

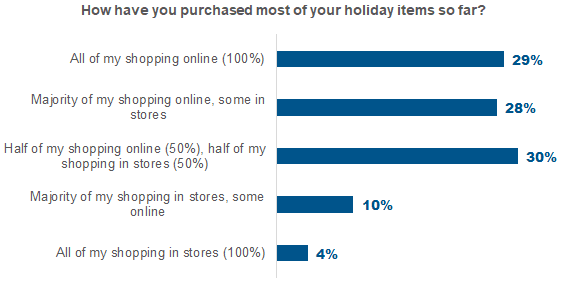

87% have done at least half of their shopping online vs. in-stores, and 29% report going digital for all of their holiday shopping this year. Those who have turned to eCommerce cited good deals and promotions as one of the main drivers, as well as the comfort of shopping from home and the ability to avoid crowds.

Source: CRC Consumer Survey, n=228

Top retailers offering early holiday deals: Several retailers have started to offer holiday-worthy promotions, primarily online-only, according to the same consumer survey data above. Amazon launched their Epic Daily Deals site for promotions throughout this holiday season leading up to their typical ‘Turkey 5’ promotional period. Target ran a Deal Days promotion from Sunday 10/10 to Tuesday 10/12, giving consumers a sneak peek at what they can expect on Black Friday. Target also began their holiday price matching guarantee, which states that if the price of an item you purchase(d) changes from now until December 24, you can reach out to Target and receive a price adjustment accordingly. Lowe’s and Home Depot also followed suit by starting to offer their version of Daily Deals where they offer a one-day-only discount on a certain product type.

Source: Southern Savers

60% of brands plan to utilize ‘Best Deals’ on Amazon for this upcoming holiday season: Our analysts have been in the field collecting data for our eCommerce Team’s Q4 Amazon Supplier Benchmark. The data aggregated so far suggests a slightly heavier promotional period for brands ahead. Preliminary data suggests 64% of brands plan to utilize Amazon’s ‘Best Deals’ promotional lever over the next few months, followed by 51% of brands planning to utilize Vendor Powered Coupons – a similar trend to Prime Day this year. For ‘Best Deals’ spend, 32% of brands plan to keep investment in-line with last year while 28% of brands planning to increase investment in this area.