Holiday Growth Trends, 2022 Advertising Plans, Hybrid Model

By Cleveland AdminHoliday Growth Trends – brands experiencing choppy holiday season

Our research suggests Amazon vendors saw better-than-expected sales performance in October, while November seemed to come in in-line to slightly below expectations due to more muted T5 performance vs. prior years, suggesting Amazon’s extended promotional period was effective in pulling forward consumer demand. Sales growth seemed to reaccelerate a bit the first week of December (week of Cyber Monday). In addition to the choppy demand trends, supply chain constraints continue to limit sales growth for many suppliers, including suppliers not being able to produce enough product and/or transportation and FC constraints making it difficult to get product over to Amazon and checked into the FCs. On average, growth trends throughout the quarter are netting out to brands still feeling confident about hitting their overall 4Q21 forecasts despite the dynamics at play.

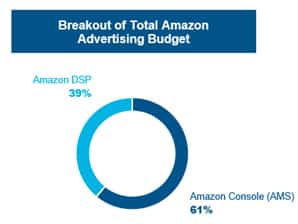

Amazon Advertising – brands expect to spend similarly on Amazon Console/DSP in 2022 as they have in 2021

On average, our research suggests that brands are planning to keep Amazon Advertising investment levels roughly in-line with this year. This includes some call-outs of increased spend among brands with less mature Amazon businesses and budgets, some call-outs of mature brands working to right-size their large budgets and potentially decreasing slightly, with most brands planning to keep spend constant to this year as a percentage of sales. While supply constraints were expected to potentially cause a pullback in spend this holiday season and into 2022, it seems most vendors are shifting spend towards products with healthy inventory levels rather than decreasing budgets on an absolute basis. Media mix between Amazon Console (AMS) and Amazon DSP is also expected to remain similar, with a slight shift towards more testing with DSP. In our research we have heard that the Amazon AMS and DSP consoles may merge into one portal in early 2022 to better map the synergies between the different available ad types throughout the course of an overarching campaign.

1P/3P Hybrid Model – hybrid vendors are running into 3P marketplace blocks

Hybrid vendors are increasingly running into issues with the 3P portion of their business, most commonly seeing an auto-message on the Seller Central account blocking the brand from launching a new ASIN, and in some cases blocking any authorized 3P resellers as well. One tactical tip from CRC’s Thought Leader Partner Retail Bloom is to create new ASINs in Vendor Central first rather than Seller Central. In order to make the ASIN available through the 3P marketplace only, immediately mark the ASIN obsolete in Vendor Central or enter in a delayed Available to Sell (ATS) date. Note: Sometimes the algorithm will still place purchase orders for unavailable items, so brands may need to cancel those line items off of the purchase order. Alternatively, these ASINs could be set up under the Direct Fulfillment vendor code, if applicable, to ensure Amazon does not order the inventory. After the ASIN is set up via 1P, it should be able to be linked to the 3P account.