Heavy Ordering at Amazon; Online Order Frequency; Boxed 4Q21 Results

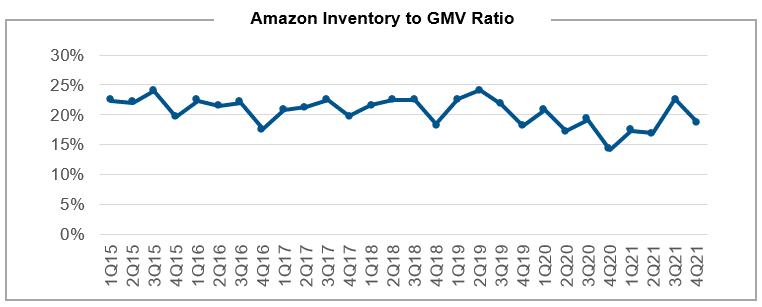

By Cleveland AdminBrands are seeing heavy orders from Amazon:

Over the last ~60-90 days, we have been hearing that Amazon has been ordering heavier than normal for a lot of vendors, bulking up its weeks-on-hand supply at Amazon fulfillment centers. The biggest driver to these heavier orders appears to be Amazon’s improved capacity situation, having now opened more fulfillment centers and invested significantly into headcount over the last 12-24 months. Amazon holding more inventory will allow it to 1) buy product ahead of further pricing action in 2022, 2) better ensure product supply (after ~2 years of challenged availability), and 3) capture more product than competitors. See our recent Amazon update for more info.

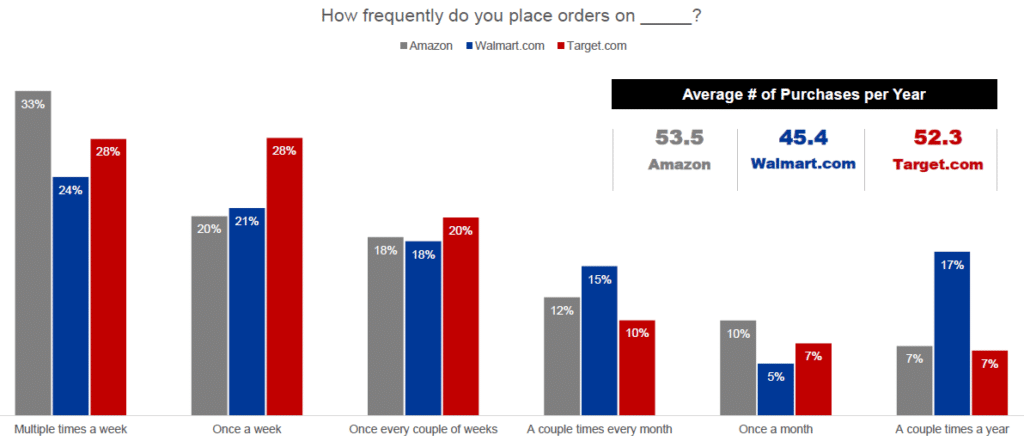

Consumers order from Target.com nearly as much as Amazon each year:

In our latest shopper comparison study we found that on average, consumers make 54 purchases on Amazon, 52 purchases on Target.com, and 45 purchase on Walmart.com each year. Interestingly, across all retailers, the majority of consumers who use the platforms shop there multiple times a week, suggesting they turn to these retailers for more than just a weekly grocery BOPIS trip. Despite similar frequency, Target.com shoppers spend on average nearly $10 more than when making a purchase on Amazon.

See last week’s polling results at the bottom of this edition to learn how frequently brands’ Amazon, Walmart, and Target teams collaborate to address the omni-consumer.

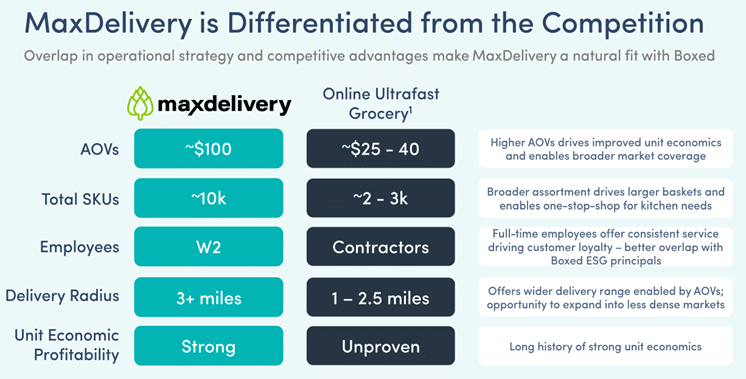

Boxed 4Q21 retail sales decreased 8.1% Y-Y; recently acquired MaxDelivery:

Boxed recently reported their 4Q21 financial results. Sales in the quarter decreased 8.1% compared to the prior year, the decline was driven by underwhelming B2C demand (4Q20 demand driven by COVID). While the company’s B2B business showed promising recovery in 4Q (up 59.3% Y-Y) it’s not quite back to pre-pandemic levels. Management noted that their average B2C customer is buying over $100 worth of goods per shop, whereas average B2B orders are more than double that. Boxed recently acquired MaxDelivery, a direct-to-door 1-hour delivery service, marking the company’s entrance into the ultra-fast delivery industry. Management noted the acquisition will help enable Fresh assortment expansion for current Boxed customers and to grow the company’s micro dark-store fulfillment capabilities. Long-term the company is excited to compete in the $100 billion online grocery market that is expected to grow 20% CAGR over the next five years. However, Boxed scale pales in comparison to some other e-commerce grocery delivery providers like DoorDash and UberEats. Lastly, like many of the other eTailers, Boxed is focused on expanding their proprietary software to sell to different customers, growing their third-party marketplace, and also building out an ad business.