Growth Trends & Outlook; Profitability; Advertising

By Cleveland AdminIn our latest Amazon research we explore recent trends, themes, and top considerations over the last 30 days. Here are our top 3 takeaways.

Some softer-than-expected sales trends in January; brands expecting similar growth in 2022 as in 2021:

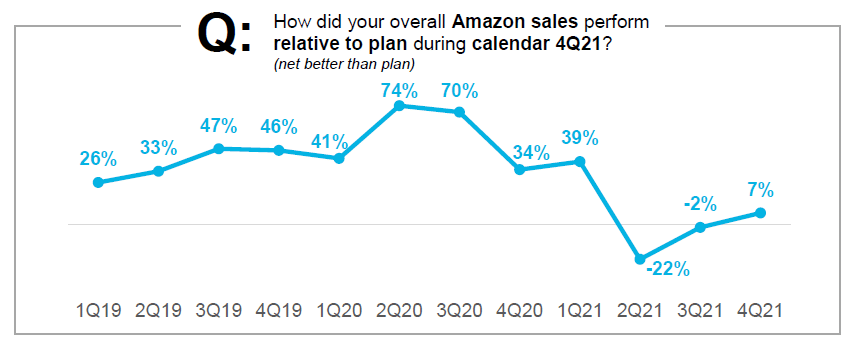

In our research we have found that overall 4Q21 sales were in-line with suppliers’ expectations, despite economy-wide headwinds around supply chain and labor. Heading into January, we saw some softer-than-expected sales trends and overall choppy demand due to supply constraints and lapping stimulus from last January. Despite this slight slowdown, brands are expecting +24% growth on the core Amazon.com platform, compared to +23% last year. We are forecasting Amazon North America GMV to decelerate to +17% growth in 2022 compared to +21% in 2021 but anticipate that Amazon will continue to outpace broader eCommerce growth, especially considering the investments Amazon has made into its fulfillment capacity and network.

Amazon continuing to place an emphasis on margin protection:

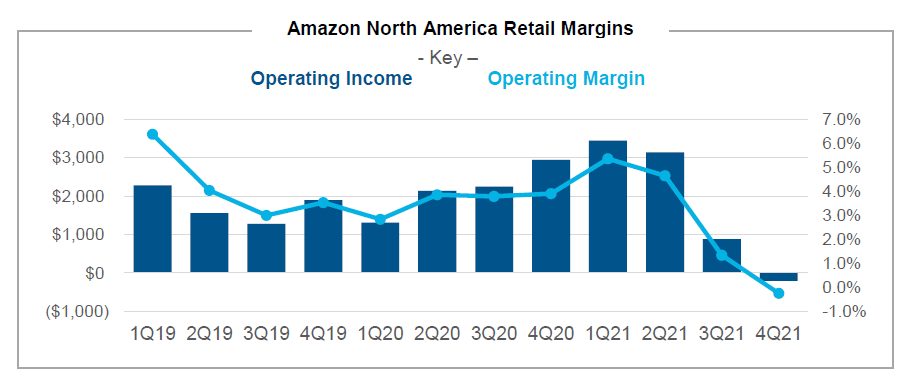

Over the last ~6-9 months we have seen a step up in margin focus from Amazon which looks to be continuing into 2022. This seems to be in reaction to sagging operating margins for Amazon as a result of increased labor, product, transportation, and COVID costs. For context, Amazon’s US operating margin turned negative in 4Q21 after being in the ~5% range during 1H21. We have continued to see more instances of deductions and chargebacks as Amazon tries to recoup some of their profitability losses. Additionally, the chief ask in AVNs as reported by brands appears to be Guaranteed Minimum Margins (GMM).

Brands continue to ramp up Amazon Advertising investments in 2022:

Although feedback on supply chain constraints and product inventory remains mixed, most brands are continuing to grow their investments in both Amazon Console (aka AMS, paid search) and Amazon DSP. Brands sound optimistic on the runway for monetization of newer areas with traction for DSP and Connected TV offerings. Even as other retailers roll out DSP offerings, it sounds like Amazon’s fees are much lower and capabilities much better than these other retailers, which should allow Amazon to continue to win in DSP. Our research suggests advertising growth did decelerate in 4Q which was reflected in Amazon’s results seeing ad revenue +32% in 4Q compared to +53% in 3Q.