Estimates for pure play, last mile provider, & omnichannel accounts

By Cleveland AdminFor this week’s edition of 3 Things, we are diving into our eCommerce Retailer Forecasts. Our forecasts can be paired with our recent 2022 eCommerce Performance Benchmark which explores brands’ expectations for eCommerce growth, penetration, mix of business and margin. Combining both perspectives can aid in more accurately forecasting for your own brand.

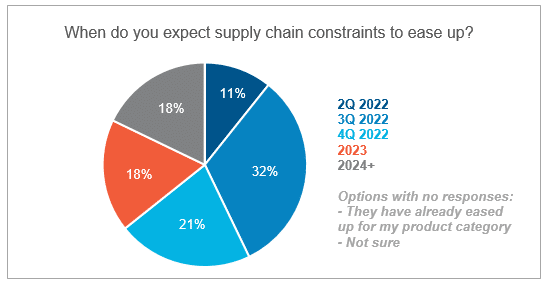

One of the chief contingencies regarding growth this year is whether the global supply chain crisis will ease or continue to pressure brands in 2022. We polled our community and found that 53% of brands are not expecting supply chain constraints to ease up until 2H22 and 36% are expecting these issues to last well into 2023 and beyond.

Source: CRC’s 3 Things 1/27/2022 Poll, n=28

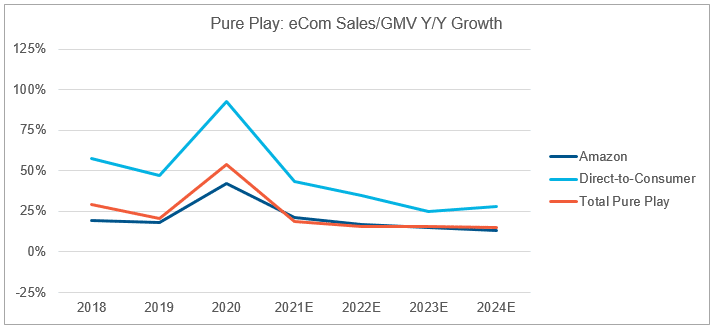

Pure Play Growth Forecasts:

Over the next 3 years, we are expecting most pure play eTailers to grow in the +5-20% range depending on maturity and supply chain impact, which is a slight slowing compared to pre-COVID growth. In particular, we see Amazon as growing in the mid-teens range, but we view this as a natural moderation given Amazon’s significant size and scale (law of large numbers). From a dollar perspective, our 2024 North America GMV estimate for Amazon is ~$500 billion, which would be 6-7xs larger than Walmart’s eCommerce business and 50% larger than Shopify. Additionally, although we are forecasting for all of these eTailers to continue to grow, it seems that DTC (primarily Shopify and BigCommerce) may continue to outpace other eTailers.

Source: Company filings and management calls, FactSet, CRC estimates

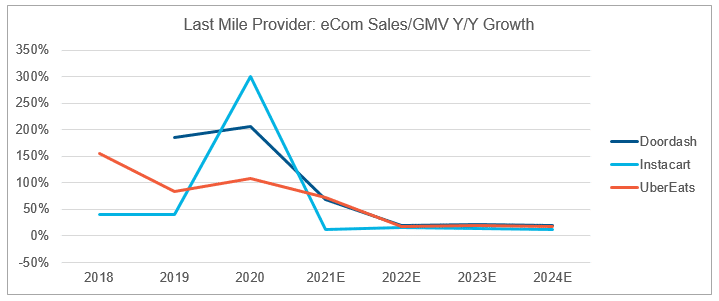

Last Mile Provider Growth Forecasts:

Large delivery aggregators saw significant growth during the pandemic with Instacart leading the way with +300% y-y growth. Since then, we estimate growth has moderated but remains strong as brands continue to see incremental wins on these third-party delivery platforms. Looking to the next three years, we are expecting these players to continue to see strong high-teens or low-double-digit growth. In our research, the top struggles brands are having with these servicers is the lack of data transparency as well as knowing who should be responsible from an internal resourcing perspective as several brands still view Instacart (for example) as more of a marketing vehicle instead of a retail customer.

Source: Company filings and management calls, FactSet, CRC estimates

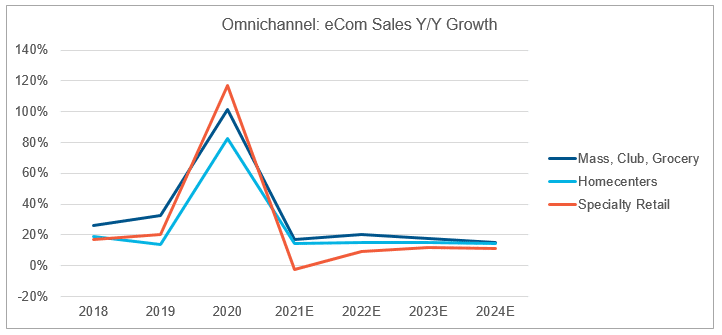

Omnichannel Growth Forecasts:

Although COVID-19 was a rising tide that lifted all omnichannel boats, Target led the way. Accordingly, we are forecasting growth in the high-teens range over the next few years for Target due to its robust fulfillment capabilities and seamless customer experience. Similarly, we estimate Walmart will experience mid-teens to low-double-digit range growth in 2022+. During 2021, Walmart did appear to suffer somewhat of a growth setback since there were executional issues when it merged its two online presences, Walmart.com and Online-Pickup-Delivery (OPD) (aka Project Glass). Though, moving forward, Walmart continues to show great promise as it holds a very large share of eCommerce from a dollar perspective and Project Glass was a strategic long-term move to elevate customer experience. More broadly speaking, we are estimating omnichannel mass, club, grocery retailers to grow in the mid-teens to low-double-digit range over the next few years.

The omnichannel homecenters and specialty retailers also saw a strong pandemic boost with over 100% growth in most cases. Coming back down to earth, we estimate that in the next few years Home Depot and Lowe’s will grow in the mid-teens range. Despite this slowing, Home Depot continues to have a leading eCommerce customer experience while Lowe’s is still playing catch up. In terms of specialty retail stores, although they saw strong eCommerce gains in 2020, we expect them to have returned back to flattish numbers in 2021 as consumers are more likely to want to “see/touch/feel” or “experience” these categories. In 2022+, we estimate they will continue to pick up growth in the single to mid-teens range.

Even with the new normal, we estimate digital penetration remains well ahead of 2019 levels. In 2022 and beyond, we expect eCommerce growth and its mix of the total business to return to growth, albeit much more modestly.

Source: Company filings and management calls, FactSet, CRC estimates