Essential Product Sales, In-Store Shopping Bans, Amazon COVID-19 Cases

By Cleveland AdminThe second round of our Amazon manufacturer benchmark indicates that Amazon’s focus the last 10 days has resulted in a widening performance disparity between essential and non-essential categories. This played out with a much wider dispersion in sales in March (66% of essential category manufacturers seeing 100%+ lifts vs. 11% non-essential) in addition to how manufacturers are adjusting their 2020 financial plans (43% of essential category manufacturers raised their ‘20 forecast by 10 points or more, while 16% of non-essential category manufacturers reduced their forecast by 10 points or more). The gap between essential and non-essential item sales will be interesting to watch in coming weeks as initial emergency stock up orders likely slow and Amazon works to normalize operations across all categories.

Vermont Bans In-Store “Non-Essential Goods” Sales

Vermont announced this week that it was directing big box retailers such as Walmart, Target, and Costco to cease in person sales of all non-essential goods. These retailers were directed to close aisles or portions of stores focused on non-essential categories and to only offer these non-essential items via online portals and telephone orders, fulfilled via delivery or curbside pick up. We have already seen a significant portion of consumer demand shift online in response to the COVID-19 crisis, however directives such as Vermont’s are likely to accelerate this process even further for manufacturers selling “non-essential items”.

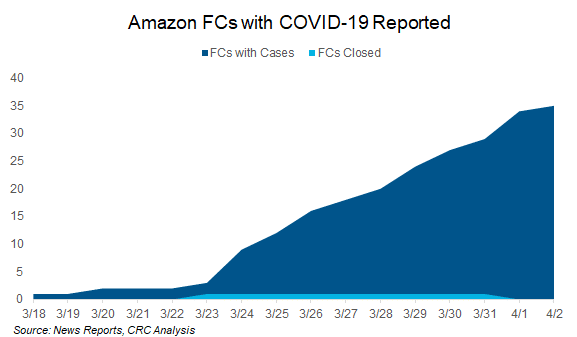

Amazon Supply Chain Increasingly Impacted by COVID-19

CRC’s analysis has found that at least 35 Amazon US facilities have had a case of COVID-19 reported among workers to date. This is causing additional strain on Amazon’s supply chain which has already been impacted by increased demand for food, household supplies, medical supplies, and other essentials, and could be contributing to some of the extended delivery times that many ASINs are seeing. Only one of these facilities, an apparel returns warehouse in Shepardsville, KY, was closed for any significant length of time, but this facility appeared to re-open this week. In response, Amazon noted today that it has begun temperature checks for all workers at select sites and expects to roll this out across the US and Europe (which has had at least 3 locations with a case of COVID-19).