eCommerce Share, Target Digital up 275%, Walmart.com and Online Grocery Growth

By Cleveland AdminFeedback from our most recent COVID-19 consumer survey indicates shoppers continue to migrate online due to the ongoing crisis. Within general merchandise, eCommerce share accelerated by 5 points since our last survey (now at 55%), with 58% expecting to purchase online over the next 30 days (vs. 54% in last survey). Key general merchandise category winners include pet products, video games, and lawn and garden. Grocery also saw a continued shift online, with 34% of consumers now making the majority of their grocery purchases online (includes both delivery and pickup, up from 27% two weeks ago) and 41% of consumers likely to purchase the majority of their groceries online in the next 30 days (up from 37% two weeks ago).

Target April-to-Date Digital Sales up 275%

In a business update today, Target noted digital sales in April to-date are trending up 275% from last year’s results, compared to in-store comps down in the mid-teens. For the full quarter (runs February through April) Target noted that digital comps are up 100%+ (for comparison, digital was up 20% Y/Y in the most recent quarter). From a category standpoint, Target saw strength in Essentials and Food (up 40% in March, and 12% in April) and Hardlines (up 20% in March and 30% in April), while Apparel & Accessories have seen COVID-19 driven weakness (down 30% in March and 40% in April). Our research has shown Target has been a strong performer for many eCommerce manufacturers during the crisis, driven by typical in-store shoppers using the digital site and extended delivery windows on Amazon.

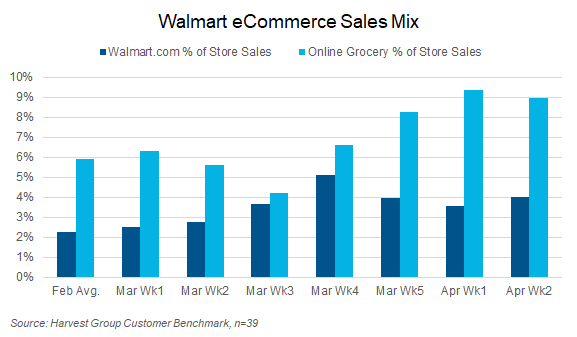

Harvest Group Data Shows Growth in Walmart’s eCommerce

Data from our partners at Harvest Group shows growth in eCommerce at Walmart as the COVID-19 crisis progresses. Interestingly, we saw an initial dip in Online Grocery penetration, tied largely to item availability and labor constraints, however once Walmart resolved those issues, Online Grocery Penetration increased dramatically. Walmart.com saw somewhat of an opposite pattern, where sales picked up significantly (more than doubling share from February’s average) before normalizing as Online Grocery usage increased, albeit at levels nearly 70% higher than before. In total, Walmart’s digital penetration has increased from 8.2% to 13% over the last 11 weeks based on the sample of manufacturers.