eCom Packaging; Discussing Price with Amazon; 4Q21 Performance

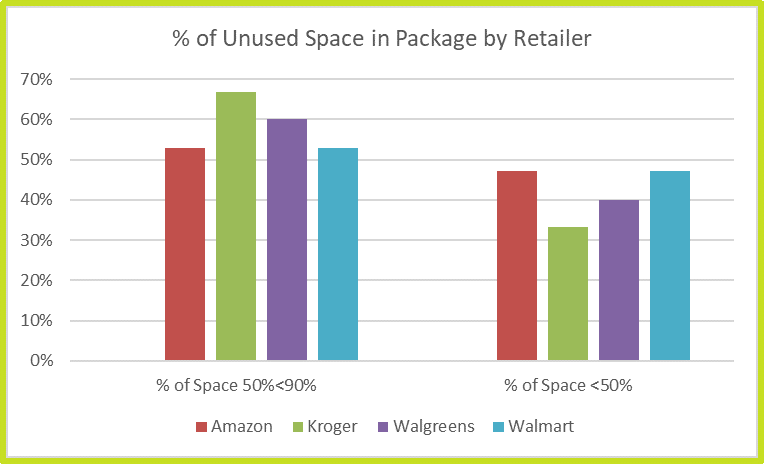

By Cleveland AdminIn a recent study, Menasha found that around ~52% of Amazon’s packages have between 50 and 90% of unused space.

As we inch further away from the peak of the COVID-19 pandemic, we are finding that consumer behavior has been permanently altered. Online shopping and home delivery have become an integral part of modern consumerism – they have become essential to how shoppers operate these days, thus forcing brands to expand their fulfillment capabilities or fall behind.

Through creating more efficient packing, brands can lessen the amount of unused space per product and also answer questions like:

• How can we improve our shopper’s experience while maintaining supply chain continuity?

• How can our brand improve our sustainability score as more and more of our customers are focused on “going green”?

• Is there any way we can improve packaging and shipping costs for long-term execution?

These questions and more will be answered in our first Thought Leader Webinar of the year featuring eCom packaging & supply chain expert, Menasha next Thursday, March 24, 2022 at 2:00 pm ET.

Click here for more info and to register.

Best practices for discussing price increases with Amazon:

Over the past few weeks our research teams have been receiving an influx of requests on best practices for discussing price increases with Amazon.

Below are a few of our top insights –

1. Provide data showing ASPs are rising throughout the marketplace as Amazon views themselves as a price follower and is likely to be more resistant to the increase if retails have yet to move and margin would therefore be compressed. Similarly, some brands have also increased MSRP (~60-90 days prior to price change) and/or their MAP policies to reflect the price increase and to make it clear to Amazon that the price increase is company-wide and not unique to the Amazon account.

2. Provide data around rising supply chain costs (e.g. materials, freight, etc. by ASIN) for greater transparency and legitimacy to the brand’s ask. Rather than instating a blanket, permanent price increase, some brands have requested Amazon accepts the price increase related to supply chain costs with the expectation that the increase could be reversed once the supply chain environment eases up.

3. Work with Amazon on something they are asking from the brand. Examples we’ve heard through our research include offering greater/full assortment to Amazon (with accompanying volume/sales expectations), incremental promotions or marketing buys, greater participation in SIOC, and participation in supply chain programs such as Full Truckload or Pallet Program.

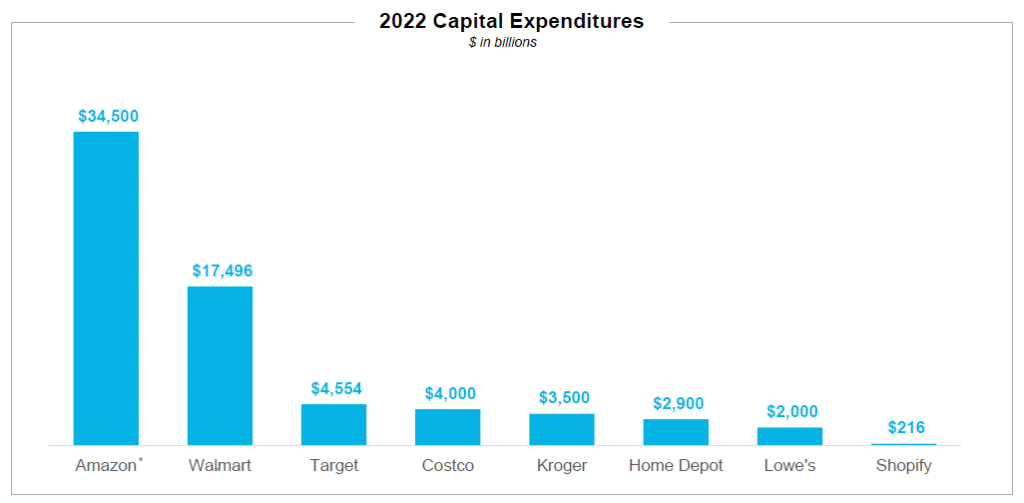

Amazon spending nearly as much as all other retailers combined:

Last week we released a report highlighting 4Q21 earnings results from the largest retailers and marketplaces. This quarter supply chain investments were brought up quite frequently as all retailers continue to build out capacity and capabilities. We estimate that Amazon will spend nearly as much as all other retailers combined to continue to expand its best in class fulfillment network. Aside from supply chain, several retailers mentioned how they will continue to create a cross-functional omni experience for their consumers. Target’s management team discussed how their omni-consumer spends 4xs more than a typical customer, and Amazon recently announced the closure of some physical stores, seemingly to prioritize Amazon Fresh B&M and Amazon Go stores.