E-Grocery Consumer: Price Sensitivity & Future Usage Outlook; Live Shopping

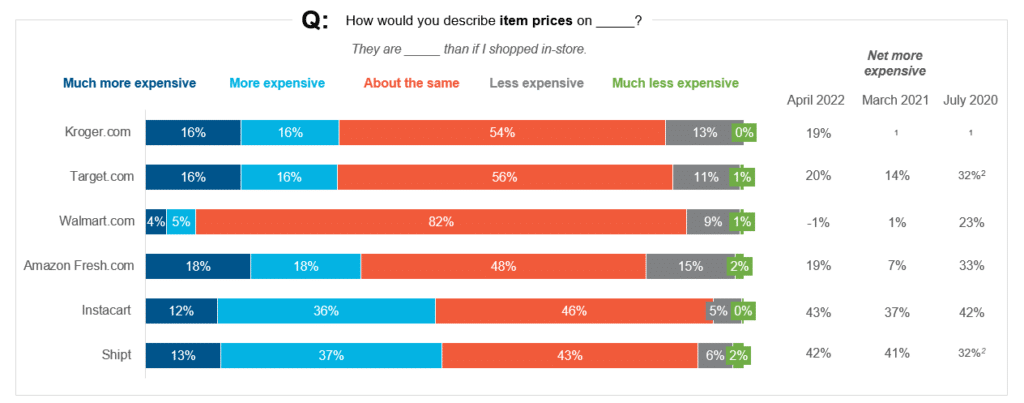

By Cleveland AdminHow do consumers view e-grocery platform pricing compared to in-store?

In our latest study tracking 1800 online grocery shoppers it was clear that the online grocery players fall into 3 tiers in terms of consumer price perception. First, is Walmart.com which is by far perceived as being most fair / cheapest as the vast majority of consumers view online pricing at parity with in-store. Second, are retailers Target.com, Kroger.com, and Amazon Fresh.com with all 3 online grocery platforms being viewed as a net ~20% more expensive than in-store. Lastly are delivery providers Instacart and Shipt, which have the worst pricing perception as a net ~40-45% of consumers view those platforms as more expensive than what the consumer would typically see inside a grocery store.

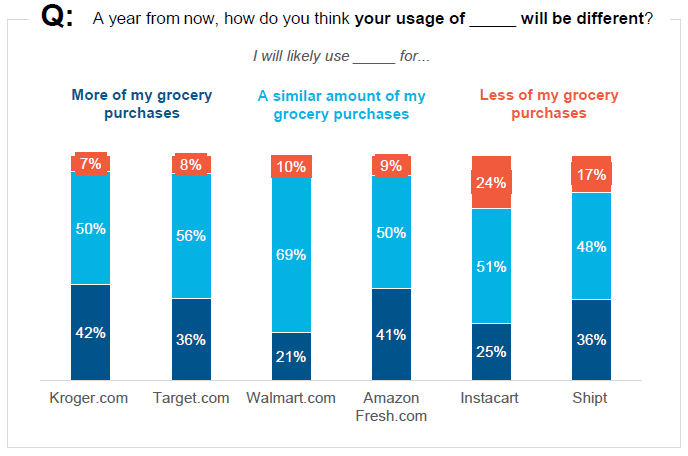

Consumers more likely to use retailers e-grocery platforms over last mile providers a year from now

In the same online grocery study, we found a net 22% of shoppers plan to purchase more groceries via these methods a year from now, however, last-mile providers had the highest likelihood of consumers using their platforms less moving forward. Additionally, Shipt and Instacart shoppers were the most likely to not use the platforms at all in a year from now. Desire to continue to purchase groceries from the online platforms moving forward appears to be driven by convenience and time savings. On the other hand, consumers that are less likely to continue online purchases cite a desire to pick groceries out themselves, less concern for COVID-19, and pricing too expensive (which was specific to Instacart and Shipt).

5 Essential Live Shopping Do’s and Don’ts:

Although live shopping presents a big opportunity for brands, it’s often challenging to know where to start or how to capture this potential growth engine. Our Thought Leader partner, Code3, has given our community 5 key items to keep in mind when approaching a new channel like this:

- Don’t look at live shopping as just social media: although Instagram may come top of mind when your brand thinks of live commerce, explore other platforms like retailer sites or alternative apps like Verishop.

- Don’t rush into live shopping: often times trialing out current marketing strategies with this new channel are unsuccessful. Instead, take the time to harness in on who your target audience is, pick the right host & platform, and create a seamless transaction process that is enticing for viewers.

- Don’t forget about the promotional strategy: make sure to invest in strategies that will boost viewership of your event.

- Don’t assume all sales will come during the live event: make sure that shoppers can still view the content and purchase the promoted products after the fact.

- Don’t get discouraged: often times it takes multiple iterations to find a successful formula for live shopping.

Click here to read more.