Club Channel Digital Funding; Shopify Growth; Amazon AVNs

By Cleveland Admin

CRC’s recent research on the club channel suggests both Costco and Sam’s Club are coming to vendors asking for digital funding. Our work suggests Costco is still resistant to sacrifice margin within its eCommerce business and is working to get vendors to cover shipping costs, or otherwise charging higher prices online than in-store. Sam’s Club seems open to digital funding support and is not pushing for any one thing in particular. Costco and Sam’s Club are two examples of the profitability pressures manufacturers are experiencing across their retail accounts. This leads them to forecast a slight decline in margin (16 bps) for their omnichannel accounts in 2021, on average, according to our benchmark conducted in early December.

Source: Business Insider

Shopify’s strong 2020 results indicate momentum within the D2C channel:

Yesterday, Shopify reported strong GMV growth of 99% and 96% in 4Q20 and for the full year, respectively, reaching $120B in 2020 (for context, we estimate Amazon GMV neared $500B in 2020). Like all eCommerce players, Shopify benefitted from the pandemic-driven shift to online shopping, and an increasing number of brands are moving digital funding into the Direct to Consumer (D2C) channel, with many leveraging platforms such as Shopify to launch more quickly and easily. Our eCommerce Teams Benchmark suggests D2C is one of the top three eCommerce accounts/channels brands are planning to hire resources for in 2021, after Amazon and Walmart.com, with 25% of brands planning to invest in D2C. Our eCommerce Summit Live Polling indicated 25% of brands already have an established D2C site and another 62% are pursuing or exploring the opportunity, with incremental sales volume and direct relationships with the consumer being the most compelling elements of D2C.

Source: Shopify

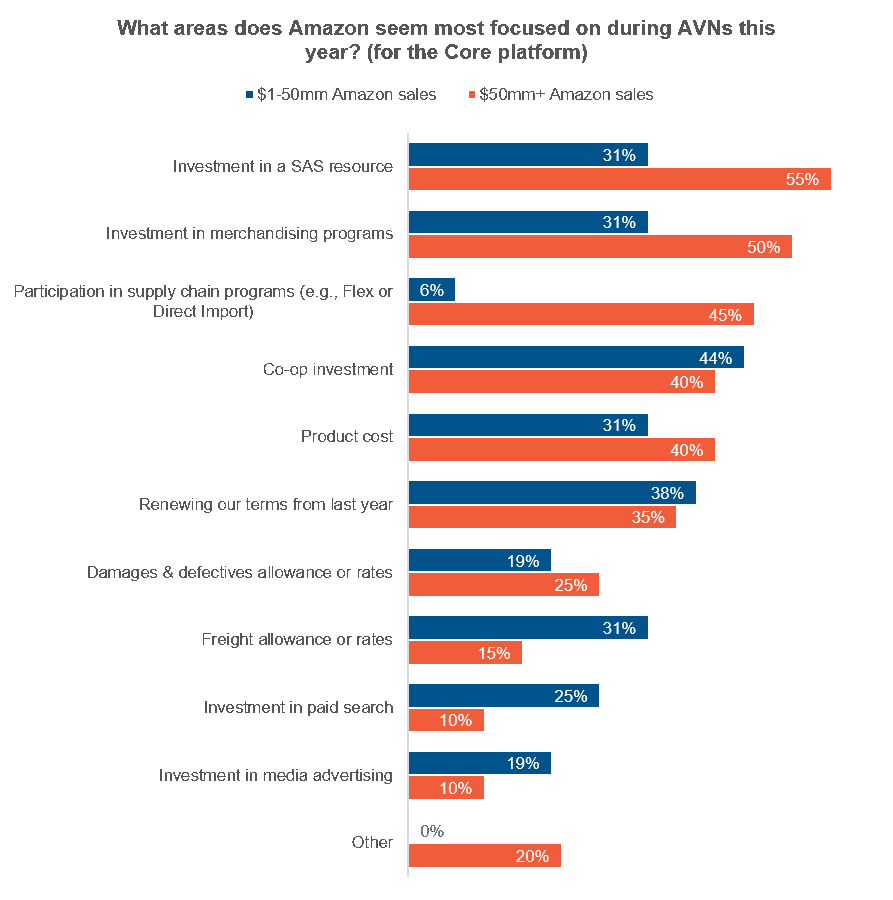

Amazon AVN focus areas for larger vs. smaller brands:

We recently benchmarked the supplier community on Amazon AVNs to shed light on how Amazon’s program costs are changing within the macro categories of Food & CPG as well as General Merchandise. We also looked at the data to review any differences in the AVN process for larger brands ($50mm+ in Amazon sales) vs. smaller brands (less than $50mm in Amazon sales). The data suggests significantly more pressure on larger brands for investment in supply chain programs, merchandising programs, the SAS program, product cost (to a lesser degree), and digital funding. On the flip side, smaller brands have seen a greater focus from Amazon on freight terms, paid search and media investments compared to larger brands.

Source: Cleveland Research, 2021 Annual Benchmark. n = 36