Digital Fulfillment: The Key Questions Your Organization Should Be Asking

By Cleveland AdminBrands are facing continued transportation and shipping costs pressures, with benchmarking data from CRC’s Traditional Retail Council suggesting it’s the top cost pressure for brands, above labor, commodities, packaging, and more. Retailers are feeling these same transportation and shipping cost pressures, which has resulted in more vendor drop ship requests or otherwise pulling back on assortment. Simultaneously, the consumer is becoming increasingly digital, wanting a variety of fulfillment options at their fingertips. Thus, in many ways, those brands with leading and agile supply chains will likely be best-positioned to win with both their retail partners and their consumers.

To help brands take action on these key themes, we’ve put together three key discussion questions for your organization to self-asses your eCommerce supply chain capabilities and evaluate opportunities for improvement.

1. How flexible and robust are our eCommerce supply chain capabilities today?

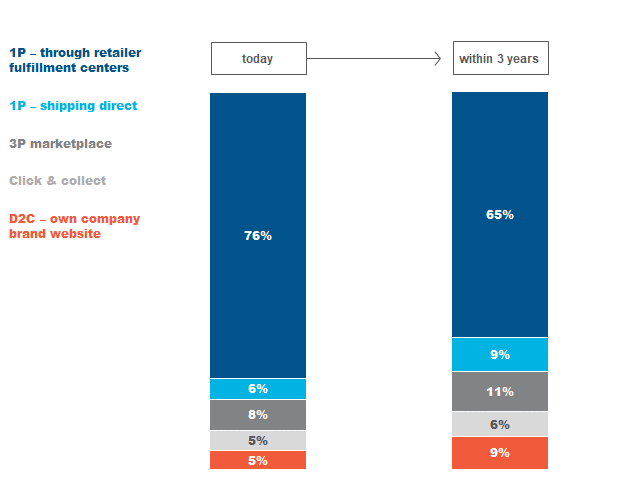

Our latest eCommerce Packaging & Supply Chain Benchmark suggests that while 76% of eCommerce volume is currently going through retailer fulfillment centers, that figure may decline by 11 points within the next three years in favor of more emerging routes such as 1P drop ship, 3P marketplaces, click & collect, and D2C. Questions to keep in mind here include:

Do you have a primary fulfillment route today that you are heavily reliant on?

Do you have the flexibility to pivot to alternate modes of fulfillment should your consumer, your retailer(s), and/or cost pressures provide a need or opportunity?

Do you have a dedicated individual or team focused on optimizing the supply chain for eCommerce specifically?

Source: CRC Packaging & Supply Chain Benchmark, n=46

2. How can we build more flexibility into our eCommerce supply chain?

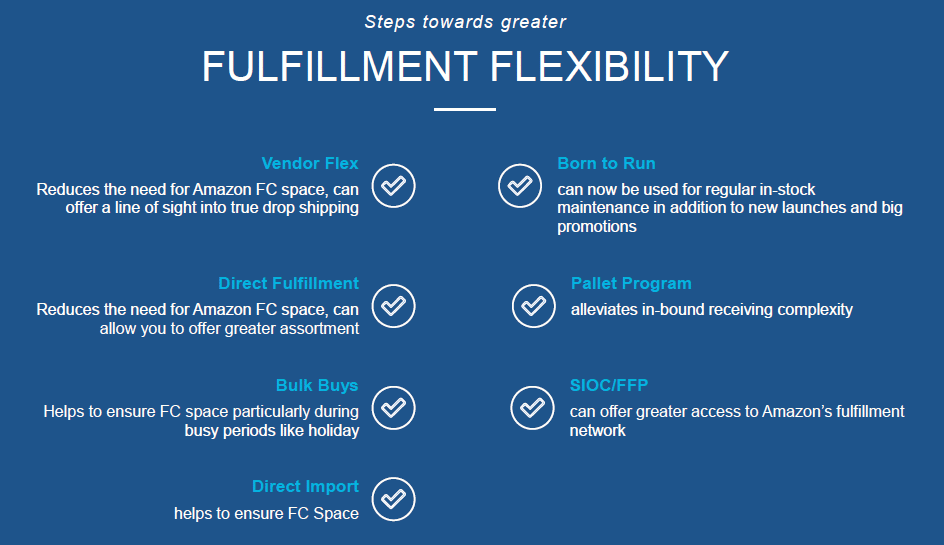

After assessing your current state, look for opportunities to further build out your supply chain capabilities. Potential opportunities could include investing in drop ship (Our latest benchmarking data shows ~75% of brands expect to have drop ship capability by the end of 2021). For Amazon specifically, our research suggests leading brands have doubled down on flexibility, using a variety of programs and levers to ultimately get their product to consumers, spanning drop ship / Direct Fulfillment, Vendor Flex, Born to Run, Bulk Buys, and more. Similarly within the omnichannel, brands that are leveraging in-store fulfillment, online fulfillment centers, and drop ship are likely best-positioned to both their retail partners and consumers from a supply chain perspective.

Source: CRC 2021 Virtual eCommerce Summit, Opening Session, Presented by Claire McBride

3. Which of our retail customers are the most flexible and forward-thinking when it comes to fulfillment?

CRC believes that the most flexible and forward-thinking retailers are likely well-positioned to win in eCommerce over the long-term. Amazon has been the historical leader here and continues to invest to stay ahead of its growing competition, announcing plans for nearly 19mm additional square feet in fulfillment center space over the course of 2020, followed by nearly 7mm square feet in 2021-to-date. Beyond FC space, they are investing heavily in their middle- and last-mile delivery capabilities, with the amount of units fulfilled by Amazon doubling in the past two years, and its delivery arm of the business more than doubling.

From an omnichannel perspective, Target is a natural stand-out, having made strategic acquisitions over the past several years (e.g. Grand Junction, Shipt, Deliv) to help power its flexible fulfillment offerings that have resonated so well with consumers, driving significant share gains for the retailer throughout the pandemic.

Walmart’s “Project Glass” initiative is an effort to create that seamless customer shopping experience similar to Target. It will merge the Walmart.com platform with its Online Pickup and Delivery platform (for grocery) for one single way to shop regardless of product category or preferred fulfillment method. Our research suggests this went live mid-September and while it has experienced some technical issues during the rollout phase (e.g. products not properly transferring over to the merged site, a clunky user experience, and consumer confusion with delivery options), we believe these issues are likely temporary in nature and the initiative will ultimately be a positive step for Walmart and their positioning in the eCommerce channel.

Walmart also announced in September their plans to hire 20,000 warehouse staff to keep products flowing efficiently to both stores and consumers’ homes, followed up by an announcement to hire an additional 150,000 individuals to ensure a smooth holiday season, but that these positions would be more so long-term store jobs rather than a quick seasonal fix. And outside of internal initiatives and investments, Walmart is also leveraging their partnership with Instacart to rapidly expand their fulfillment reach, along with Giant Co. and Kroger as of recently (with Ocado being another critical partnership for Kroger in regards to digital fulfillment), and many others.