CRC’s 2022 eCommerce Summit; Instacart Update; Inflation

By Cleveland Admin

Jet set to sunny San Diego for the 10th annual show:

We’re excited to return in-person for CRC’s 2022 eCommerce Summit in San Diego, CA! The Summit will include a cocktail reception the night of September 14th, followed by a full day of content on September 15th with a networking event that evening.

Click here to register. In the coming months we’ll be in touch with more information surrounding the specific content, speakers and a detailed schedule.

Note: As a reminder, 5 free tickets are included for Full eCommerce Council Members via your company-specific customer discount code. Additional tickets are available for purchase. Feel free to simply respond to this email for questions surrounding registration or remaining ticket availability.

Brands most often fund Instacart investments through brand or shopper budgets:

We recently published CRC’s latest Instacart report in which we explore 2022 sales growth forecasts, expected level of investment, budget allocation, advertising capabilities, and Instacart’s new/emerging ventures. The most common question we get from our eCom council members is how other brands fund Instacart investments. Our research suggests no standard formula for where Instacart ad dollars are “taken from” as it appears to be a blend of brand, shopper, and trade dollars. While it varies by organization, it seems most common to secure dollars from either brand or shopper budgets. Because Instacart does not hold its own inventory, most brands cannot justify using trade spend on the account. Moreover, Instacart has to balance their retailer partnerships delicately as to always appear as a partner rather than stealing any B&M business. Brands using trade spend on Instacart could be seen as such.

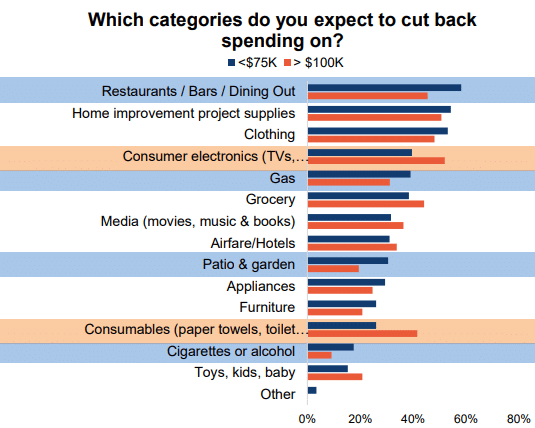

Inflation likely to impact spending regardless of income level:

80%+ consumers indicate they will cut some spending if inflation continues to rise in 2022. Lower income households (annual income < $75K per year) are much more likely to cut back on discretionary items such as Restaurants, Home Improvement, Gas, Cigarettes / Alcohol while higher income households (annual income > $100K) are much more likely to reduce spending on Consumer Electronics and Consumables.