Shifting Digital Preferences; Online Grocery Forecasts; Kroger + Instacart Partnership

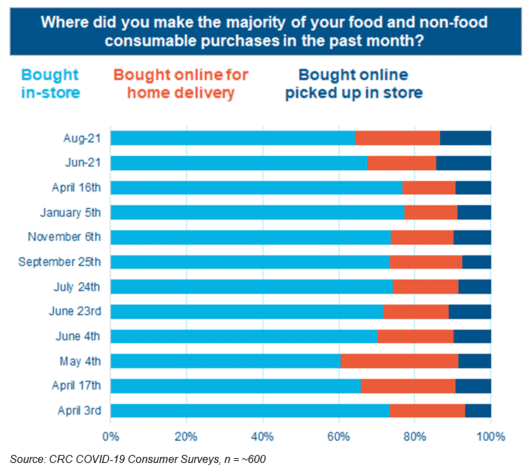

By Cleveland AdminThroughout the pandemic, consumers’ preferences for purchasing groceries in-store vs. online have ebbed and flowed. In our most recent round of work, we found yet another reversion away from stores with 35% of consumers saying they did the majority of their grocery shopping online. This is a step up compared to the ~30% we saw in June 2021 and comparable to levels we saw in April of 2020 right at the start of COVID-19.

Our consumer work also suggests more online grocery shoppers are utilizing home delivery compared to in-store pick-up, although the pandemic has shown us that all three options (in-store shopping, home delivery, and BOPIS) serve a unique role for the consumer. Thus, the brands that focus in all three areas, with an emphasis on flexible supply chain capabilities, will likely be best-positioned to take and maintain share regardless of ever-evolving consumer preferences.

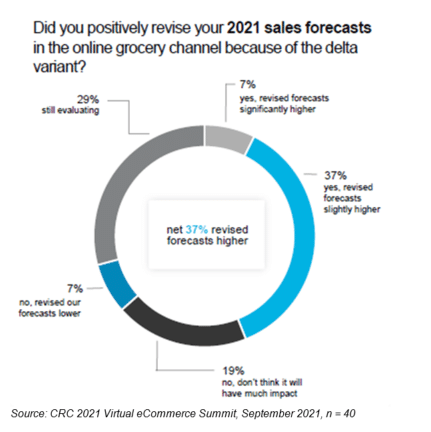

Rise in COVID-19 cases leads grocery brands to raise 2021 eCommerce forecasts:

Given the uptick in consumers’ online grocery purchasing, brands have adjusted their 2H21 forecasts accordingly. At our recent 2021 Virtual eCommerce Summit, we polled the audience live and found a net 37% of brands positively revised their 2021 sales forecasts in the online grocery channel because of the delta variant. These trends, and the expected stickiness of eCommerce post-pandemic, are leading brands to continue to invest in their online grocery accounts. Our live polling suggests Instacart, Walmart Online Pickup & Delivery, and the Amazon core platform are slated to receive the most attention from brands heading into 2022. 67%, 58%, and 58% of brands report ramping up focus and/or investment respectfully. Surprisingly, Shipt is only a priority for 8% of brands, which may potentially increase if the CitrusAd partnership rollout is successful, helping to elevate Shipt to Instacart’s level.

Kroger has partnered with Instacart to launch “Kroger Delivery Now” nationwide:

Mid-September, Kroger announced the launch of their new nationwide delivery service, coined “Kroger Delivery Now” (KDN), in partnership with Instacart. This service will offer shoppers 30-minute delivery of fresh food, household essentials and more through the Kroger app or website, in addition to being available on Instacart’s new “Convenience Hub” for their respective marketplace. The “Convenience Hub” feature allows Instacart Express members to shop for convenience essentials 24/7 with free ‘Priority Delivery” on orders over $10 in 30 minutes or less – which Instacart says was born out of increased demand for rapid delivery. Instacart reports that nearly 20% of customers report selecting Priority Delivery when they checkout and that convenience orders are up more than 150% since May.

In terms of KDN, Kroger has stated that it can reach up to 50 million households, and is a step in the right direction toward meeting their ambitious goal of doubling both their digital sales and profitability rate by the end of 2023. The KDN delivery service will not only service strictly Kroger branded stores, but also Ralphs, Fred Meyer, King Scooper’s, Fry’s, Mariano’s, and Smith’s – all under the Kroger family name. Both the “Kroger Delivery Now” consumer experience and Instacart’s “Convenience Hub” are steps towards meeting consumer demand whenever and wherever they want.

Source: Supermarket News