Consumers Returning to Stores; Walmart’s Special Bonuses; ’21 Growth on Amazon

By Cleveland AdminOur consumer research suggests delivery to home has continued to decline for the past month for groceries but has remained relatively consistent for general merchandise purchases. For groceries, the peak appears to have occurred in May with 31% of consumers reporting they received deliveries to the home vs. 17% in our most recent study. For general merchandise categories, our most recent research indicates 41% of consumers made the majority of their purchases via online delivery to the home in June, up from the 20% we saw at the beginning of April and essentially the same as the results from our study at the beginning of June. We will continue to monitor to what degree these categories diverge, and how any resurgence in the virus impacts these trends.

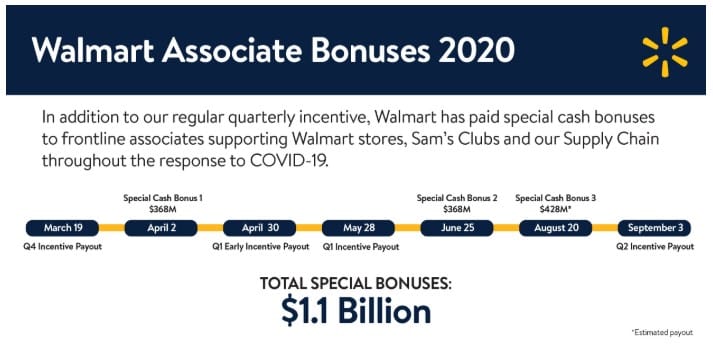

Walmart’s Special Bonuses:

Walmart is investing another $428 Million into special bonuses for employees for their continued support of store operations during the COVID-19 pandemic. This brings the retailer’s total for special bonuses to $1.1 billion. Full-time hourly associates will earn $300 and part-time hourly workers will receive $150. Walmart is extending these special bonuses to those working in stores, clubs, distribution and fulfillment centers, as well as to drivers. Many omnichannel and eCommerce retailers are investing in operations, team members, and technology to keep their employees safe and to get products to consumers faster. Amazon also announced last month it will spend more than $500 million on one-time bonuses for its front-line workers and said it plans to invest $4 billion into COVID-19 related expenses.

Source: Walmart.com

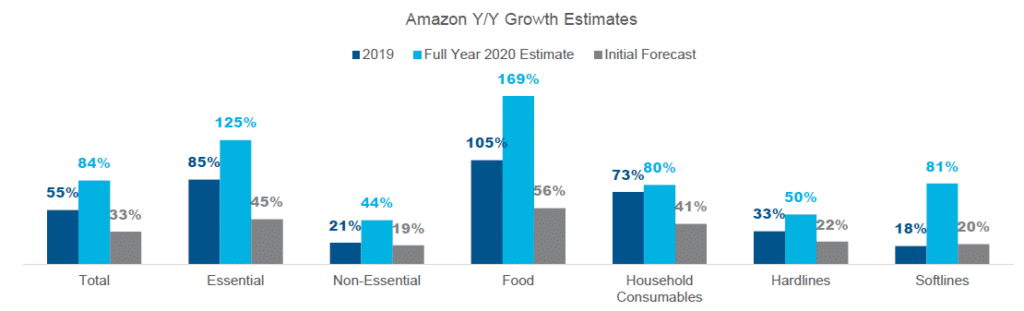

’21 Growth on Amazon:

Forecasting 2021 growth on Amazon continues to be challenging with questions around the degree to which consumer behavior is permanently vs. temporarily changed. However, our recent manufacturer benchmark suggests manufacturers are expecting to grow an average of 33% in 2021 after seeing dramatic sales spikes in 2020. These growth estimates are led by Food and Household Consumable brands expecting a growth rate of 56% and 41% respectively. Meaningful investments into sales support, operations, technology, and digital activations, will have to be evaluated further to achieve this growth.