Consumers Choosing Amazon, Private Label Ads, Dropshipping

By Cleveland AdminAmazon Continues to Dominate Path to Purchase

Our data suggests that online shoppers are expecting to purchase more on Amazon over the next 12 months and Prime membership has increased meaningfully vs. last year. Beyond shopping on Amazon, consumers are also using the platform as a research tool – discovering, learning more, looking up consumer reviews, and comparing price on the site. It is therefore important to remember that regardless of where the purchase takes place, Amazon is consistently playing an integral role in your consumers’ path to purchase. Price still rules when it comes to shopping, with 56% of Amazon shoppers citing it as the number one reason to shop on Amazon, followed by free shipping (52%), and reviews (32%). The importance of price shows up every year in our studies and is one of the reasons Amazon continues to focus on competitive pricing, both within its 1P business and more recently with 3P sellers via its Sold By Amazon initiative.

Amazon Pushing Private Label at Point of Purchase

A Washington Post article from last week indicates that Amazon has begun pitching private label products to consumers immediately above the option to add a branded product to cart. The article notes that Amazon has begun promoting these private label products across a number of consumable and CPG categories, in an effort to accelerate growth. Our research has indicated that while Private Label remains a significant threat to branded manufacturers on Amazon, only a small number of brands have actually seen private label take noticeable share in their category to date. Potentially in response to the article, Amazon has removed this promotion on a number of the products mentioned in the article.

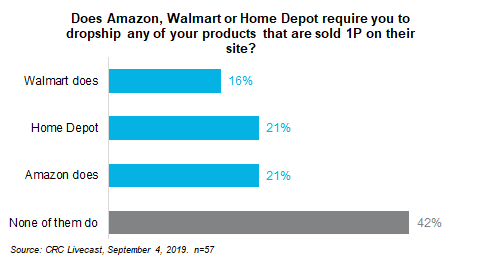

We continue to hear more manufacturers being pushed by key customers like Amazon, Walmart and Home Depot to dropship directly to customers, either selling wholesale or through a marketplace

The results from our most recent Livecast suggest brands are seeing this most frequently with Amazon and Home Depot, although Walmart is not far behind. Interestingly, the data suggests that most manufacturers that are having to dropship products only have to do it on some of their accounts, rather than multiple. This suggests each retailer has its own financial model it evaluates when determining whether to require a manufacturer to dropship. Given the difficultly omnichannel retailers face with making eCommerce profitable, we expect most retailers to shift more of the shipping burden onto suppliers in 2020, particularly for longer-tail items.