Commerce Marketing, Amazon Pickup, 3Q Results

By Cleveland AdminCommerce Marketing

Amazon is an important destination for shoppers along each point in the path to purchase, and a strong presence on Amazon can yield positive results across channels, both digital and physical. As a result, manufacturers have evolved their funding of Amazon Advertising over time. Our commerce marketing teams study suggests that a slight majority of brands now see Amazon Advertising primarily as a marketing spend (vs. trade spend). This represents a shift from just a few years ago, when the majority of brands viewed Amazon Advertising as a trade spend. In contrast, most omnichannel retailer advertising programs are just getting started. As a result, brands are typically taking a test & learn approach on these programs, contributing relatively small amounts that are allocated from existing trade spend. The pace at which marketing budgets shift to funding these new ad channels will primarily be driven by the retailers’ ability to demonstrate high ROI’s via convincing attribution models and reporting. Even with many national account managers for these omnichannel accounts wanting to spend more, they too have to convince their organizations that the new advertising options are compelling when compared to alternative channels like Amazon, Google or Facebook.

Amazon Expands Pickup Program

Amazon announced this week that it is expanding it’s Counter program, a network of pickup points that consumers can choose to have packages delivered or returned to instead of shipping to home. This expansion includes locations at GNC, Health Mart, and Stage stores, and expands on the builds on its existing Amazon Lockers and its partnership with Kohl’s for return locations.

Amazon Earnings

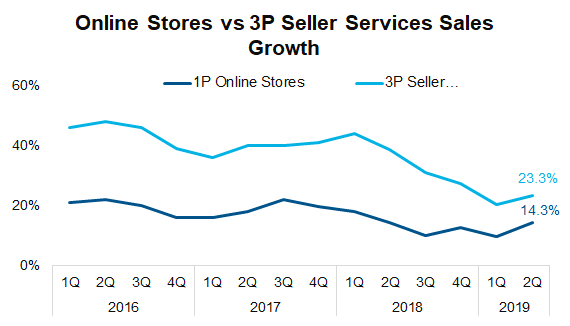

Amazon will report its quarterly earnings this evening, which we will be closely monitoring. Our work has indicated Amazon has been more focused on growth in areas such as assortment, where the eTailer appears to be more flexible on items that it previously delisted due to profitability concerns. In addition, with the implementation of one day shipping, we expect strong growth results in 3Q like we saw in 2Q. We will also be watching the level of investment into shipping initiatives, as the eTailer invested $800 million in 2Q into overnight shipping last quarter, which is expected to grow in 3Q.