China update; Strong domestic consumption levels; Slight drop in COVID-19

By Cleveland AdminChina update – less severe than anticipated COVID-19 impact on workers, supply chain, and overall production

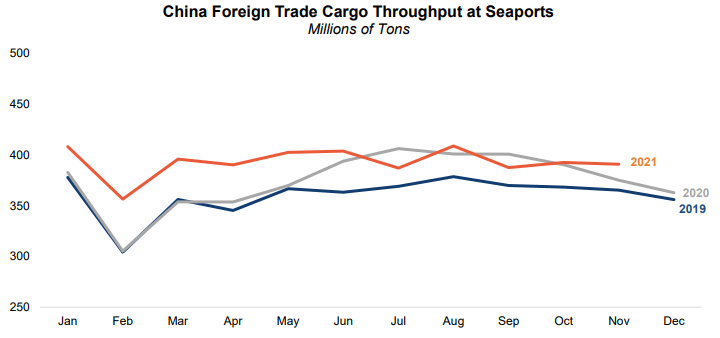

Although the Omicron variant of COVID-19 continues to have impacts across the globe, it seems that China has done a relatively good job to contain the infection. In our research we have found that China’s “Zero-COVID Policy” surrounding contract tracing, mass testing, and strict isolation guidelines has in part contributed to the recent decline in cases across China’s major cities. Moreover, only 3 provincial-level regions of China are currently seeing daily new cases greater than 10, a sizeable decline from 5 regions the week prior. In terms of production, as is typical with past years, we are expecting there to be some slowdown in the next couple of months due to the Chinese New Year. Though, if COVID-19 continues to be kept at bay as much as possible, along with less people traveling due to China’s “Chinese New Year in Place” initiative, we may see a faster return of production in 2022 than in 2021. This is encouraging considering the dip in China’s foreign trade cargo throughput was already less steep in 2021 compared to years prior.

The outlook on consumption levels for 2022 remains favorable, despite inflationary pressures

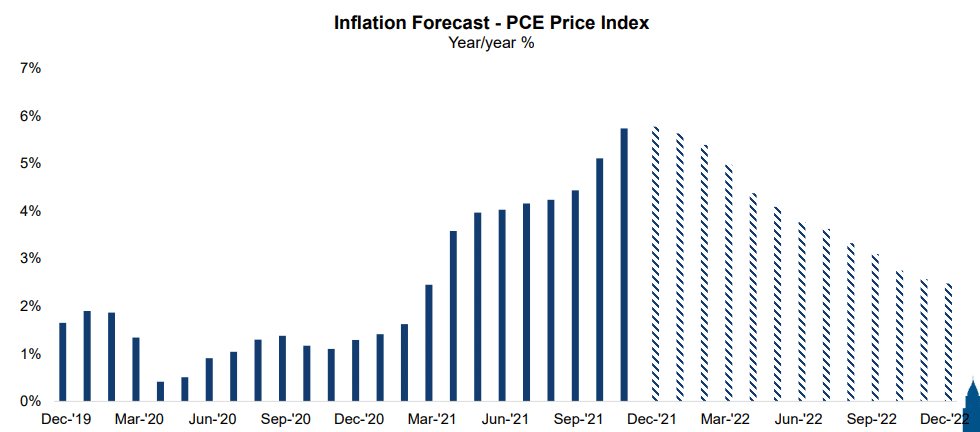

As production challenges continue across the board, our macro team is forecasting total PCE inflation to increase 3.9% in 2021 and 3.8% in 2022. Despite this inflationary environment, nominal consumption continues to look favorable based on positive retailer outlooks, restocking activity, and an overall rising wealth effect (i.e. housing prices and other investments appreciating). Still, we believe it’s likely we see total PCE inflation stay above 5.4% the next 3 months as Omicron adds more uncertainty into the supply chain. Inflation is likely to gradually reverse in the second half of 2022 as anticipated interest rate hikes drive some purchase impact, global supply chain disruptions ease, and year-ago comparisons become tougher (base effect).

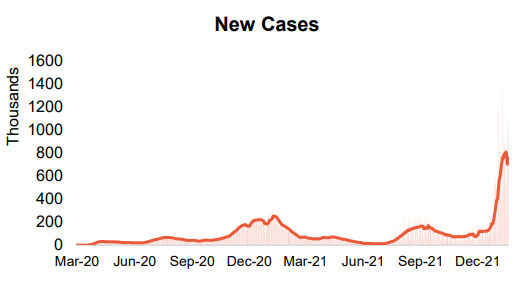

COVID-19 Omicron wave may reach plateau in late January or early February

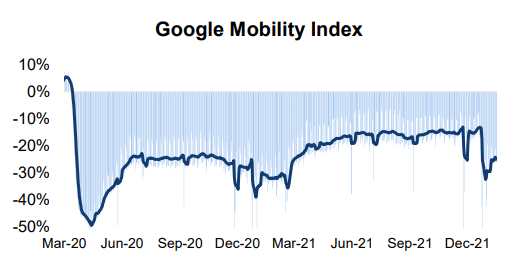

New COVID-19 cases in the US have finally declined 4.7% over the past week, which is the first weekly decrease since the COVID-19 Omicron variant was first detected in November 2021. Although cases are still rising in states that have not been hit by the variant as hard yet, earliest hit states seem to be reaching a plateau. We would anticipate mobility to begin to slowly improve after falling ~15-20 pts as Omicron cases spiked. For most of 2021, the mobility index we track was down 15% range compared to 2019, with the lack of commuter traffic likely making up most of the difference.