Boomers and Online Grocery; Amazon’s New Private Label Brand; Prime Members’ Flexible Fulfillment

By Cleveland Admin

Our generational consumer study shows COVID-19 drove online grocery adoption for all generations, but most notably for Boomers as 58% of these shoppers reported that they started to shop for groceries online sometime between March and December of 2020 (compared to 55% for Gen Z, 44% for Gen X, and 42% for Millennials). Boomers are primarily using search to add items to their cart (80%), although many are also leveraging “previously purchased lists” (55%) and “shop by deal” widgets (60%). Our data suggests Boomers are the least open cohort to discovering new products online, suggesting product launches targeted for this generation may be more challenging on digital grocery sites.

Amazon launches another food private label brand:

Amazon recently rolled out another private label food brand, Aplenty, in its Fresh B&M stores as well as online. The brand currently offers items such as chips, cookies, and mustard, with plans to expand to hundreds of items across center-store categories like confections, snacks, condiments, seasonings, baking mixes, and pantry staples, as well as frozen foods. Aplenty boasts better-for-you features including no artificial flavors, synthetic colors or high-fructose corn syrup. The rollout of this brand is another example of Amazon’s persistent pursuit of private label (as well as its broader strategy within grocery). However, CRC’s past consumer research suggests Amazon private label penetration is still relatively low, particularly in food categories, with only 5% of Prime members reporting purchasing the Happy Belly brand (coffee and snacks) and 5% purchasing the Mama Bear baby food brand.

Source: Supermarket News

Prime members over-index to in-store and BOPIS grocery shopping vs. non-members:

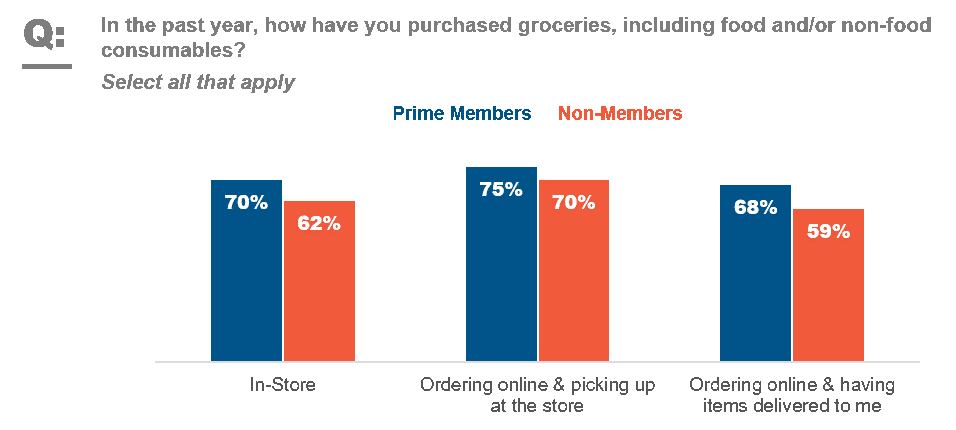

It’s not surprising that Prime members are more likely than non-members to have their groceries delivered to their home (9 points more likely). Our consumer data shows they’re also more likely to leverage BOPIS grocery offerings and even shop in-store. This supports the idea that the most digitally-savvy consumers also see value in shopping in-store and prefer to have flexible fulfillment options. This validates Amazon’s pursuit of the B&M grocery market and reiterates the importance for manufacturers to have the ability to service the consumer for all fulfillment methods rather than just one platform, such as online grocery.

Source: CRC Online Consumer Study, March 9, 2021, N=1,391 respondents total