Average Team Size; Vendor Manager Engagement; How Brands Manage Amazon Advertising

By Cleveland Admin30% growth in Amazon teams in 2021; Headcount growth expected to slow in 2022

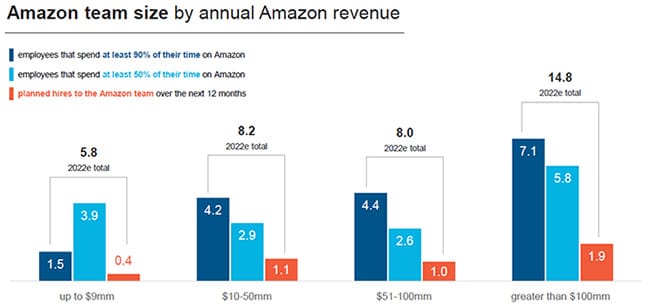

Our benchmarking data suggests 2021 was another big year for building the Amazon team, along with 2020. On average, Amazon teams currently consist of 4.6 dedicated individuals compared to 3.6 last year, with 96% of surveyed brands reporting at least one team member dedicated to Amazon compared to 85% last year. On average, brands have 3.9 individuals with part-time responsibilities towards the Amazon account compared to 2.9 last year. In total, this average Amazon team of 8.5 compares to 6.5 last year, implying ~30% growth. Brands may slow down Amazon headcount growth in 2022 vs. the past two years, as our benchmark shows total planned dedicated Amazon hires of 1.2, implying ~15% Y/Y growth or roughly half of what was seen in 2021.

Are vendor managers becoming less accessible?

Anecdotal feedback from brands suggests vendor managers (VMs) have become less communicative and helpful over time, as the number of Amazon vendors has grown substantially and, subsequently, the VM role often seems under-staffed with a high degree of turnover as well. However, our benchmarking data shows 89% of brands have regular contact with their VM, which is in line or higher than studies done in prior years. Not surprisingly, larger businesses tend to get more attention from the VMs, with 95%+ of Amazon vendors over $50mm in sales reporting regular VM engagement.

While engagement may not be decreasing substantially, what may be more likely is that the scope of the VM role has narrowed over time, with this individual having less power and/or capacity to help with brands’ tactical needs such as new item set-up or promo execution. Amazon’s SAS program can help to provide brands with this type of tactical support they used to receive from their VMs. According to our benchmark, 68% of brands are utilizing an SAS resource, up from 44% a year ago.

Amazon Advertising: in-house management vs. outsourcing to an agency

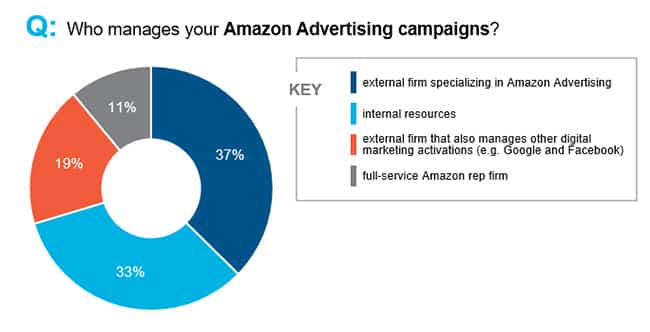

Our benchmark shows one third of brands managing Amazon Advertising campaigns with internal resources, with the remaining two thirds leveraging external partners, most commonly (37% of all brands) a firm that specializes in Amazon Advertising. Our benchmarking data supports the intuitive idea that less headcount is likely required for brands that are utilizing an external partner to manage Amazon Advertising spend. Of these brands, 67% have full-time resources towards Amazon Advertising vs. 79% for brands managing in-house, while 44% have part-time resources vs. 12% for brands managing in-house. However, hiring plans are roughly similar to brands managing in-house, with 27% planning to hire dedicated resources towards Amazon Advertising compared to 31% for brands managing in-house.

About half of all brands report the Amazon team has primary responsibility internally over Amazon Advertising, regardless of if the brand is managing campaigns in-house or outsourcing. Distant seconds are the centralized eCommerce team and the digital marketing team (i.e. the team managing search, social, etc.).