Annual Vendor Negotiations; Digital Advertising Spend; 4Q Amazon Sales Performance

By Cleveland AdminMany vendors are kicking off the Annual Vendor Negotiation (AVN) process with Amazon. While the level of asks on basic terms like accruals and return allowances seem quite varied among brands, a common theme we’re seeing in our research is Amazon asking for greater participation in several supply chain programs, with pallet ordering, Vendor Flex, and the Full Truckload program being the most frequently cited thus far. We recommend referencing our Amazon Supply Chain Benchmark in the midst of these discussions with Amazon, which covers adoption rates of various supply chain programs on Amazon and whether manufacturers are seeing a positive ROI on these programs. As an example, 34% of Food & CPG suppliers and 26% of Hardlines suppliers participate in Full Truckload. A slight majority of these suppliers (56%) report that the program has met their expectations, although a third of suppliers indicated the program fell below expectations.

Source: Logos.fandom.com

Digital advertising set to account for over half of all advertising spend this year

COVID-19 has led advertisers to turn to digital platforms in a meaningful way with digital ads expected to reach over $110B this year, or 51% of the total US ad spend, GroupM (a WPP unit) as reported in the Wall Street Journal. GroupM expects the mix of digital ads to grow even further to 54% in 2021. This compares to digital advertising making up only one third of all ad spending just three years ago. It comes as no surprise that Amazon, Facebook, and Google are the largest beneficiaries of this massive shift towards digital. Amazon’s advertising business grew 51% in 3Q as we’ve seen brands funnel more dollars into Amazon Advertising due to cancelled or less aggressive in-store activations throughout the pandemic. We’re forecasting Amazon’s advertising business to surpass $20B in revenue in 2020 and reach $29B in 2021.

Source: Clever Solution

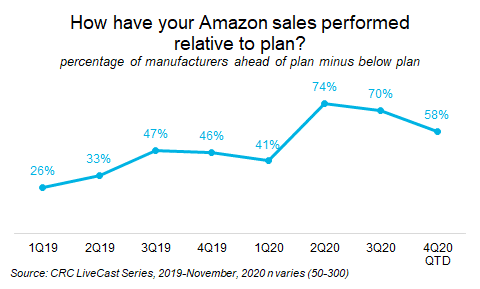

4Q sales on Amazon off to a strong start for a net 58% of manufacturers:

We polled the supplier community on Amazon quarter-to-date sales trends during our recent LiveCast (before the Turkey 5 promotional period), in which 65% reported better than expected sales, compared to 7% seeing worse than expected. The net result of 58% ahead of plan is strongly positive, but less so than the data we gathered in 2Q and 3Q. We’ll continue to keep a pulse on performance during the holiday promotional period which is proving to look unique this year, as more consumers turn to eCommerce in the wake of rising Coronavirus cases and as Amazon and other retailers work to stretch out the timing of demand.