Amazon’s Growth, YouTube and Instagram, FC Investments

By Cleveland AdminAmazon’s 4Q19 results came in very strong, with 1P sales growing 15% Y/Y (vs. 22% last quarter) and 3P sales reaching 30% Y/Y (vs. 27% last quarter). This translates to an estimated $12B in gross merchandise value in N. America on a Y/Y basis. Much of what is driving this strength is very healthy underlying Prime membership, which has reached 150mm members, up from 100mm in 1Q18. In addition, growth was supported by the roll out of 1-day delivery. The company also indicated grocery delivery from either Fresh or Whole Foods stores more than doubled Y/Y during the quarter, helped by the removal of the fee and improved service offering (2 hour delivery). We expect this growth to continue into 2020 as the eTailer continues to benefit from expanding assortment, one day prime delivery, and removal of barriers for online grocery including expanding geographies and removal of fees.

Instagram and YouTube Advertising Revenue

This week Google revealed the size of its YouTube advertising business for the first time, stating that advertising revenues on the platform were $4.7B in 4Q (up 31% Y/Y) and $15.2B for 2019 as a whole (up 36% Y/Y). This represents ~9% of Google’s total revenues for 2019. Bloomberg also reported this week that Instagram revenues were around ~$20B in 2019, representing more than a quarter of Facebook’s total revenues. By comparison, Amazon had revenues of around $14B in 2019. We would expect these totals to continue to rise in coming years as advertisers continue to shift budgets online as consumers increasingly move online.

Fulfillment Network Investments

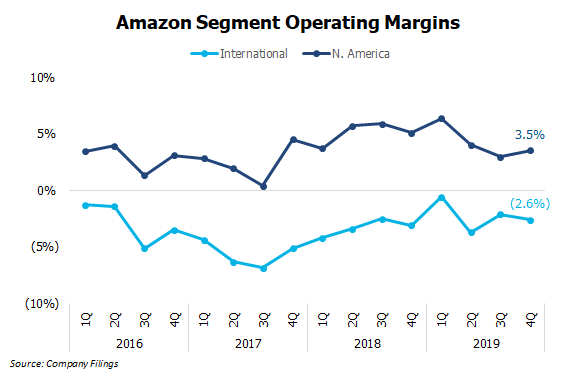

Amazon’s renewed sales growth has required significant investment by the eTailer, which is weighing on margins to some degree in the short term. While these investments are limiting profits in the near term, we view them as a long term positive for Amazon, as it creates a significant competitive advantage vs. other retailers and also enables continued growth in other areas such as advertising. In the short term, management commentary last week indicated that costs from the one-day delivery program and the corresponding impact on margins, will likely persist at least into 2020. Commentary points towards fulfillment centers being an area of renewed investment in 2020, with management highlighting warehouse sq. ft. growth will likely be greater than the 15% Y/Y seen in 2018 and 2019, as one day delivery pushes the eTailer to locate inventory even closer to consumers. This investment should help to continue Amazon’s sales momentum in coming years, particularly in areas such as grocery where investments into F3 could help to drive consumers to shop the category. However, this is also likely to cause the eTailer to continue to ask manufacturers for increased funding to enable these investments.