Amazon Updates; Prime Day, Pharmacy Launch; 2Q Share Gains

By Cleveland AdminOur recent consumer study suggests that 51% of Prime members made a purchase during Amazon’s Prime Day this year (vs. 45% last year). Our research also suggests that Amazon was able to add a great deal of members during the shopping holiday period and its device sales performed particularly well. However, Amazon wasn’t the only winner during Prime Day. Our data shows that ~50% of those that purchased something on Amazon during Prime Day also bought something at other retailers such as Walmart and Target. While search was the most popular way to find products during Prime Day, a large percentage indicated that they watched a live stream during the event. This is likely due to the fact that Amazon Live was featured on the home page and potentially suggesting consumers’ growing use and interest in this form of shopping.

Source: Amazon

Amazon Pharmacy Launch:

Amazon is making its biggest push into the healthcare industry with the launch of Amazon Pharmacy, a prescription medication home delivery service. Amazon says Prime members will get a number of benefits as part of this offering including free, two-day delivery on orders, and discounts on medication. According to the company, Prime members will be able to save up to 80% on generic and 40% on brand name medications when paying without insurance. Those that have Prime will also be able to save on medications across over 50,000 US pharmacies including Rite Aid, CVS, Walmart, and Walgreens.

While the move is significant for Amazon it’s not unexpected as Amazon has been working to enter the healthcare space for some time. In 2018, the eTailer acquired PillPack for just under $1 billion. Walmart has also recently made a foray into the healthcare industry with plans to expand its Walmart Health footprint to 22 locations by the end of 2021. The healthcare industry is worth over $300 billion with an annual growth rate of about 3% mainly driven by the rise of online stores and home delivery. It remains to be seen who can stand out in this category as consumers continue to prioritize digital in the midst of growing COVID-19 cases.

Source: Amazon

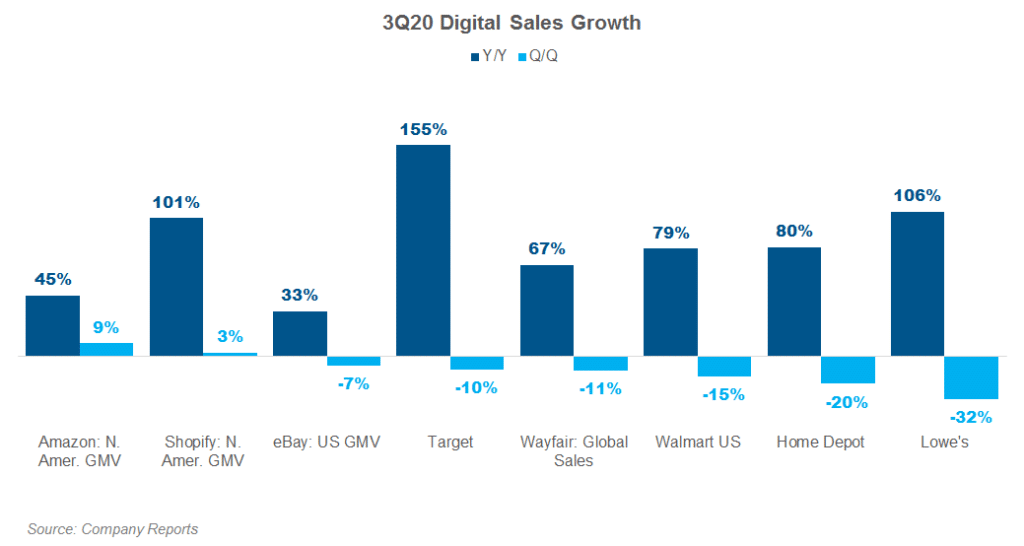

Amazon Regains Share in Online After Disruptive 2Q:

Several companies have reported their 3Q results recently, illustrating how the eCommerce market has performed since July. The chart below illustrates that digital growth remained elevated during the past quarter, with Target, Lowe’s and Shopify seeing the fastest Y/Y growth. However, we found the Q/Q data telling, as only Amazon and Shopify saw larger demand in 3Q compared to the height of the pandemic in 2Q. This suggests that for Amazon in particular, its share losses that occurred in 2Q when it turned off non-essential goods, appears to have reversed with consumers coming back onto the platform. Its $23B in incremental sales growth Y/Y is greater than the sum of the incremental dollar growth of the other seven retailers shown. We do anticipate Q/Q increases for the eCommerce market during the holiday period, as consumers end up spending more time at home given new levels for daily coronaviruses cases. We also expect Amazon to be much better positioned to avoid the disruption it saw in 2Q as it has worked to increase capacity and has the most robust COVID-19 testing capabilities amongst its retail rivals.