Amazon Updates: Volatile POs; Same-Day Delivery Expands; Price Increases Likely

By Cleveland AdminMany brands saw extremely light purchase orders (POs) from Amazon in May, with the eTailer pointing to tight fulfillment center space ahead of Prime Day. However, our latest supplier benchmark suggests a net 12% of Food & Consumables brands and net 23% of General Merchandise brands are still seeing lighter POs than normal. Amazon is also holding 14% less inventory than normal, on average.

Many brands have described their PO activity as sporadic, whether that be enormous orders one week followed by low/no orders the next, or even random orders throughout the week. To manage, brands are looking at bulk buy opportunities for 2H21 and evaluating fulfillment alternatives such as Vendor Flex and Direct Fulfillment. Another common strategy for manually supplementing orders is to utilize Amazon’s Born to Run (BTR) program. However, some brands have seen decreases to the amount of inventory they are allowed to put through BTR or are seeing the program turn off completely for them. While these instances are not broad-based, this is similar to what Amazon did last year during the pandemic spikes and holiday time frame in an effort to better control the amount of inventory coming into its fulfillment centers. Amazon mentioned constraints throughout their fulfillment network on their 2Q2021 earnings call, suggesting brands can expect these dynamics to continue through 2H21 and perhaps into 2022.

Source: Amazon

Amazon expands same-day delivery to an additional six U.S. cities:

Last week Amazon announced that they would be expanding same-day delivery to six more cities in the U.S., bringing the total to 12. The first locations to receive this service were sizeable metropolitan areas like Philadelphia and Dallas. Now, Prime members in Baltimore, Chicago, Detroit, Tampa, Charlotte and Houston can take advantage of this feature as well. On Amazon’s 2Q21 earnings call, management stated they are still playing catch-up to get to pre-pandemic delivery speeds, and confirming they are working aggressively to get up to speed and beyond.

This is critical for Amazon to maintain its competitive position as other eTailers are also investing heavily to expand their own capabilities. Our recent Home Depot research suggests the leader in omnichannel home improvement continues to build out its fulfillment capabilities, with plans to offer nationwide same-day/next-day delivery when its current investment plan is complete at the end of 2022.

Source: Amazon

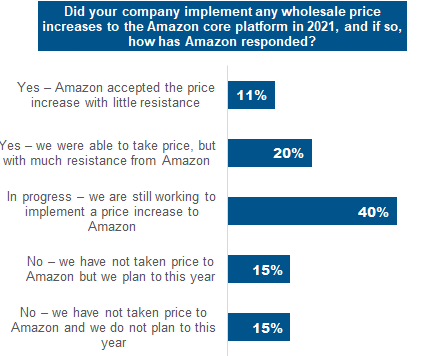

18% of brands have successfully passed price to Amazon, another 49% are currently in progress:

Our benchmark and broader research suggests price increases are inevitable for almost all brands, as 85% of brands surveyed either have already passed price to Amazon, are working through a price increase now, or are planning to pass price at some point this year. The average price increase for the first wave seems to be mid-single digits, although a significant number of brands plan to pass an additional price increase sometime in 2021. If brands are having difficulty taking price, they will have to weigh the importance of the price increase, the negative effect of stopping shipments, and the brand’s market share and leadership position within the category (i.e. how important the brand is to Amazon and therefore how much leverage the brand has).

Source: CRC Amazon Supplier Benchmark, July 2021, n=81, 39 Food & Consumables respondents and 42 General Merchandise respondents