Amazon Shipping Times, Best Buy Online up 250%, eCommerce Share Gains

By Cleveland AdminOur most recent Amazon Vendor Benchmark indicates shipping times are delayed by 2.5-4.6 days on average for manufacturers in the benchmark. Our research suggests this has hurt conversion rates to a degree on Amazon, opening the door for its rivals like Walmart.com, HomeDepot.com, Wayfair and others to gain new customers over the short term. However, based on the benchmark, it does appear Amazon is gaining its fair share of the shift to eCommerce channels, with manufacturers reporting it now accounts for 15.1% of their US retail sales vs. 10.6% in 2019. The improving shipping times seen over the last week in addition to greater availability of non-essential items will likely minimize the share gain opportunity for Amazon’s rivals in the back half of April.

Best Buy Online Sales up 250%

In a business update this week, Best Buy noted that for the last ten days of March, US online sales were up over 250% Y/Y, as brick and mortar closures pushed consumers to use eCommerce solutions. Best Buy management noted consumers were using a mix of delivery and curbside pickup, with each representing about half of total online sales. Despite this strength online, Best Buy also noted that total sales during this period were down about 30% Y/Y. We anticipate that many retailers will see significant online growth in both 1Q and 2Q as our work shows consumers are shifting a large portion of their purchases to online solutions as stores close and consumers work to obey shelter in place orders in many states.

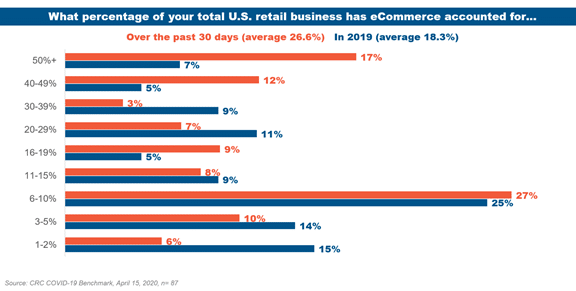

eCommerce Share Grows 9% over last 30 days relative to 2019

Our most recent benchmark of Amazon vendors indicates that on average, vendors have seen eCommerce sales share grow from 18% in 2019 to 27% over the last 30 days. This is likely driven in large part by “essential categories”, where 42% of surveyed vendors have seen Amazon sales up at least 100% vs. expectations under normal conditions, while 52% “non-essential category” vendors have seen demand on Amazon down relative to expectations under normal conditions.