Amazon SAS Program; Shop Pay Expands; Amazon 1Q21 Sales Growth

By Cleveland Admin

Amazon has increasingly pushed manufacturers to invest in what they now call their Strategic Account Services (SAS) resource [previously known as Strategic Vendor Services (SVS) and Amazon Vendor Services (AVS)]. In our recent manufacturer benchmark, 44% reported currently using the program (vs. 39% in our July 2019 benchmark), and 67% of those brands believe the investment has been worth it compared to 54% in July.

We attribute this increase to Amazon listening to manufacturers’ feedback on the program, and manufacturers refining how they work with the SAS resource to get more out of the service. Our benchmark suggests the SAS program is most effective at promotional execution, coordination with the vendor manager, and new item set up, while its weaknesses include paid advertising campaign support, A+ content optimization, and enhanced customer insights.

Source: Amazon

Shopify’s Shop Pay expands to Facebook and Instagram:

This week Shopify announced that its payment option, Shop Pay, will be available to all Shopify merchants that are also selling on Facebook and Instagram. Shop Pay pre-populates consumers’ details at checkout, resulting in a 70% faster checkout process on Shopify and a 1.72x higher conversion rate for merchants. The Facebook and Instagram partnership represents the first expansion of Shop Pay off the Shopify platform, and it reinforces two important themes in today’s retail environment.

The first is the continued blend of what used to be distinct entities – retail, brands, and media – with brands becoming retailers through their Shopify D2C sites and expanding commerce to social media sites as well. To remain competitive, brands need to be present on these platforms that consumers are increasingly turning to for commerce, which has implications on staffing, marketing investments, and go-to-market strategies.

The second key theme is the consumer’s desire for convenience. When consumers discover products or interact with brands on social platforms, they want to be able to make a purchase then and there, with a quick and painless checkout process such as Shop Pay. Aligning your attention and investments with the retailers and platforms most focused on the consumer experience, including convenience, will likely pay long-term dividends as this trend continues.

Source: Shopify

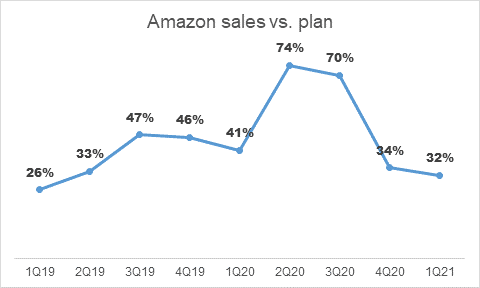

1Q21 off to a strong start for 32% of brands on Amazon:

We polled the supplier community on Amazon sales growth during our LiveCast, in which a net 32% of suppliers reported 1Q21 sales (to-date) ahead of plan. This lines up with our broader research as we’ve received feedback from many brands that Amazon ordered aggressively in January. We’ve been tracking this metric since 2019 and while this most recent figure was lower than what suppliers reported in 2020, we attribute the result to brands resetting expectations at a higher baseline rather than an actual deceleration in sales especially with the growth of Amazon Strategic Account Services.

Source: CRC LiveCasts and supplier benchmarks, n varies