Amazon Price Matching; Holiday Growth; Private Label Shoppers

By Cleveland AdminOur research indicates that Amazon appears to have gotten more sophisticated with its price matching algorithms, with manufacturers now seeing Amazon match offers that historically had not been captured. Examples we have seen include matching gift card promotions at Target, matching smaller retailers such as Menards or Walgreens, matching in cart offers at retailers like Home Depot, and continuing to match club prices at a per unit level. One way brands have been able to limit matching of club prices is by using size AND other attribute variations, such as flavor, that are different from what is available on Amazon, although they believe the effectiveness of this is likely temporary.

Holiday Season a Positive for Online Sales

A WSJ article citing data from Mastercard SpendingPulse, indicated eCommerce sales from November 1 through December 24th grew 18.8% Y/Y, compared to 1.2% sales growth in-store. Despite a late Thanksgiving pushing back and compressing the holiday shopping season, overall retail sales grew 3.4% over that period, with digital claiming 14.6% of total sales. Amazon also issued a press release highlighting the strengths of its holiday business including billions of items delivered, continued growth in Prime membership, and growth in one-day and same-day Prime delivery – although the lack of hard numbers makes year over year comparisons of Amazon’s holiday season difficult. Overall, we view eCommerce’s holiday growth as an expected but still positive development, as consumers continue to look to do more of their shopping online.

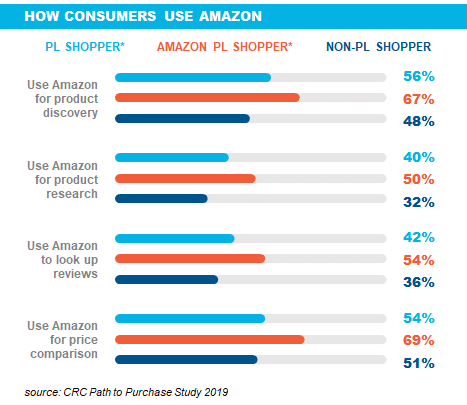

Amazon Private Label Shoppers More Engaged across Path to Purchase Our recent path to purchase survey indicated 97% of Private Label shoppers are using Amazon at some point on the path to purchase (for instance, discovery, research, price comparison, etc.). Nearly 60% of these shoppers are Prime members (vs. ~45% of non-PL shoppers), and 54% expect to purchase more from Amazon in the following year (vs. ~43% for non-PL shoppers). While prior research has shown that private label has limited share across most categories on Amazon, this high degree of engagement is expected to keep Amazon focused on growing its private label business despite antitrust criticism that suggests it has an unfair data advantage.