Amazon Posts, Target’s Same-Day Services, Walmart’s New Omnichannel Team

By Cleveland AdminWe continue to hear more manufacturers testing Amazon’s new Posts feature, which essentially looks similar to an Instagram post and can be found on various different areas of the mobile site, such as on brand-owned detail pages, related brand detail pages, related post feeds and category feeds (Amazon chooses where the Posts show up). Consumers can click on these posts and are taken to the product detail page.

Manufacturers tend to be recycling social media assets for content needed on Posts. Feedback suggests conversion is positive although traffic is more limited given it is hard to find these on the site. We recommend manufacturers participate considering the program is self-service and available for free, which essentially amounts to free advertising (albeit limited control on where it is featured on the site). 26% of brands that joined our LiveCast in late-February are currently using Posts.

Target’s 20% eCommerce Growth in 4Q Driven by Same-Day Fulfillment

This week, Target reported 4Q eCommerce growth of 20%, a deceleration compared to 31% in 3Q. Similar to Walmart and other retailers, our research suggests the relative slowing was in part driven by Amazon’s dominance during holiday with its growing Prime membership base, 1-day delivery, broader assortment, and more aggressive pricing and promotions.

Target management noted that its same-day fulfillment services (order pickup, drive up, and Shipt) saw over 90% growth in the quarter and accounted for over 80% of its overall eCommerce growth. The company stated that the service has driven incremental sales, as nearly one-third of people that placed a same-day order in 2019 had never before shopped on Target.com. Looking ahead to 2020, the company will continue to invest in its digital fulfillment services and plans to test a curated assortment of fresh food and adult beverages available through pickup and drive up.

Walmart Merging B&M and Digital Merchandising Teams

Walmart recently announced it will be merging its B&M and digital merchandising teams to create one omnichannel team for each of its six main categories: apparel, consumables, entertainment/toys/seasonal, food, hardlines, and home. We view this as a positive move for not only Walmart, but for manufacturers and the consumer as well. Historically, manufacturers have been challenged by the siloed nature of the Walmart teams, resulting in disjointed assortment, promotional planning, and advertising. The new structure should help create a more seamless working relationship between the retailer and manufacturer teams, and a more cohesive shopping experience for today’s omnichannel consumer.

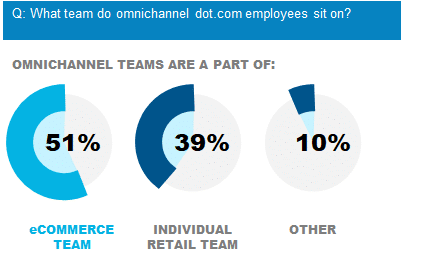

This organizational change is yet another example of the blending we’re seeing between B&M and online retail, as well as the blend between retail and advertising. This increasingly dynamic environment requires collaborative team structures within manufacturers’ organizations. Our 2019 team benchmark indicates about half of omnichannel teams report into eCommerce and 39% report into the B&M team. We see both structures working, so long as the teams work closely together and take a collaborative approach that is supported by shared services.